Activity ramps up amid lockdown easing

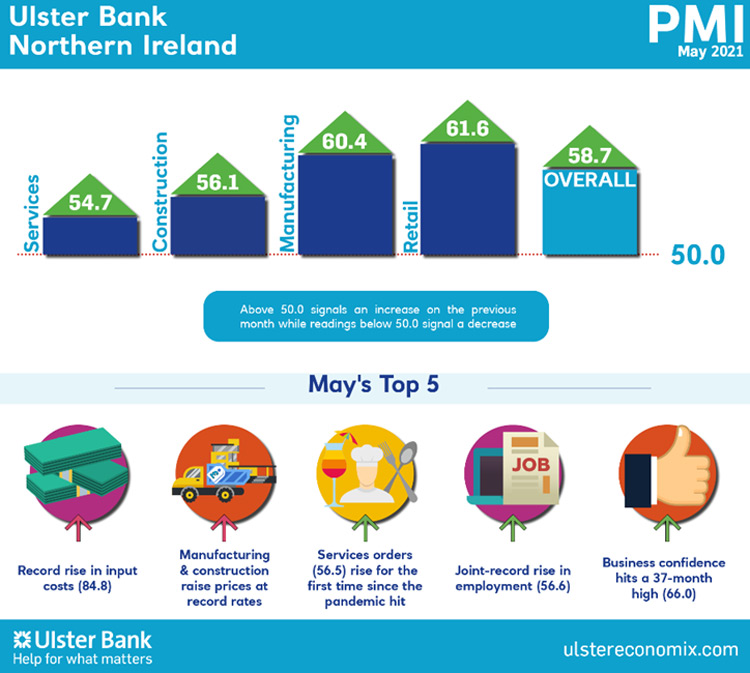

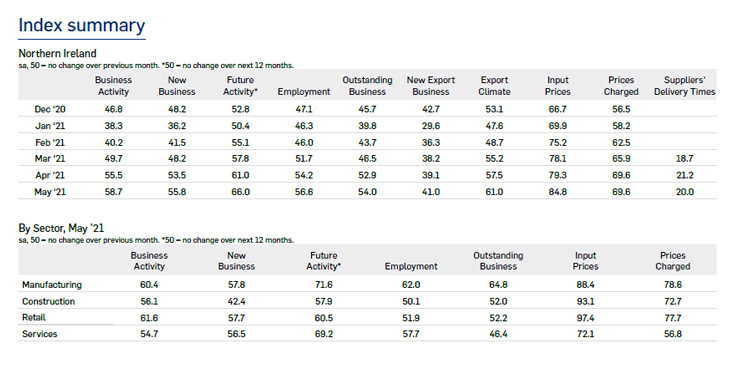

Today sees the release of May data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by IHS Markit – pointed to marked improvements in new orders and output. The extent of the increase in workloads meant that firms expanded their staffing levels at a pace unsurpassed in almost 19 years of data collection. That said, inflationary pressures remained elevated, with the pace of increase in input costs accelerating again.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

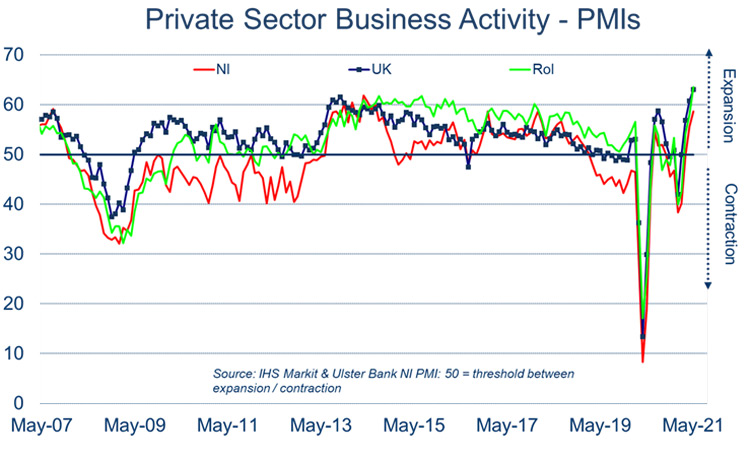

“PMI surveys around the world hit record highs in May. These included the UK and Republic of Ireland – the two most important economies for driving Northern Ireland’s recovery. With the further loosening of lockdown restrictions, business conditions improved significantly in Northern Ireland too. While falling short of record highs, local firms did report the fastest rates of expansion in business activity and new orders in 40 months. The last time local businesses posted faster rates of output growth was back in the summer of 2014.

“All four sectors saw output growth for the first time since January 2019 with retail and manufacturing recording the fastest rates of expansion with PMI readings in the sixties. Northern Ireland’s services firms finally posted a pick-up in new orders for the first time since the pandemic took hold. Construction was the only sector not to see a pick-up in new orders with incoming demand falling significantly and marking the sixth successive month of decline. This contrasted starkly with UK construction firms which saw new orders hit the fastest growth rates to date.

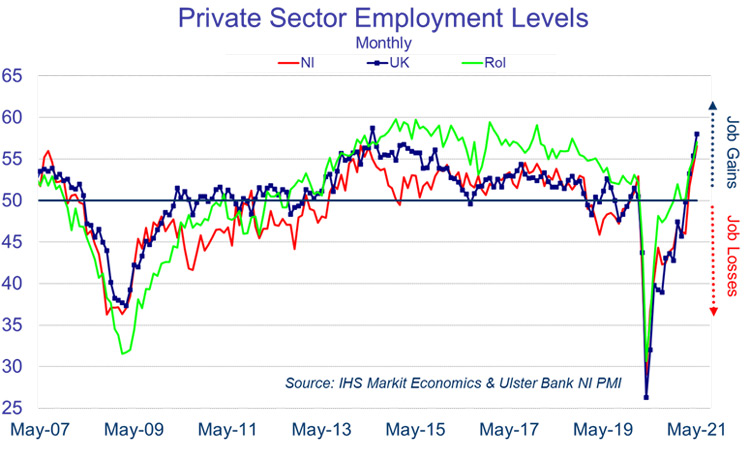

“The rest of the local PMI survey was littered with highs. Strong growth in domestic demand has led to a pick-up in hiring with local firms increasing their headcount at the joint-fastest rate on record. Manufacturing led the way with staffing levels rising at the fastest pace in the survey’s history.

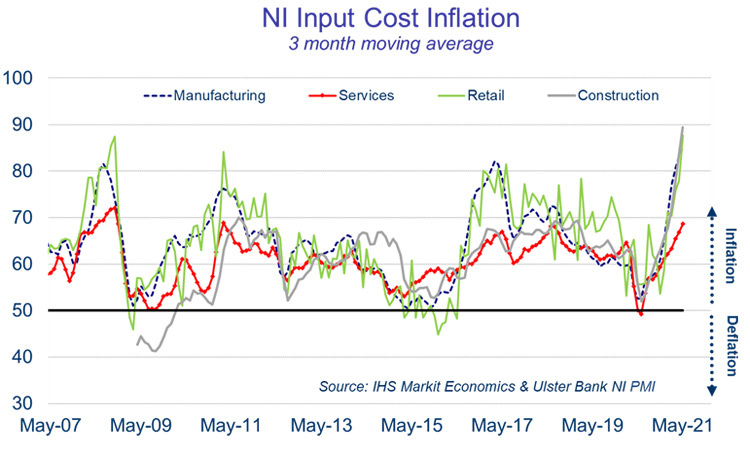

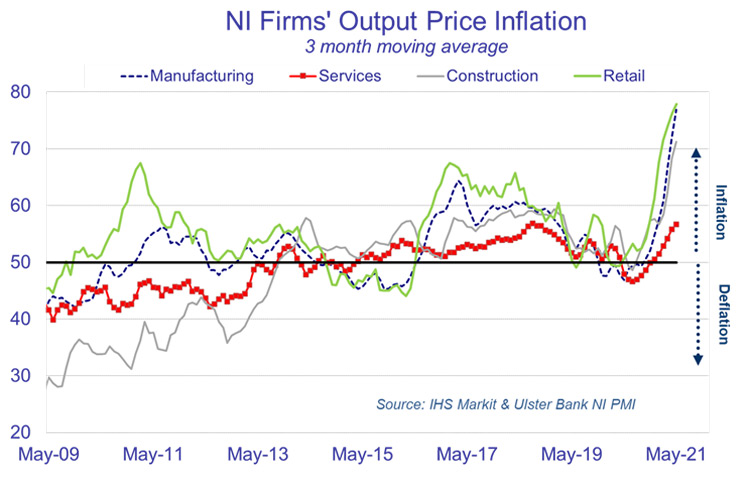

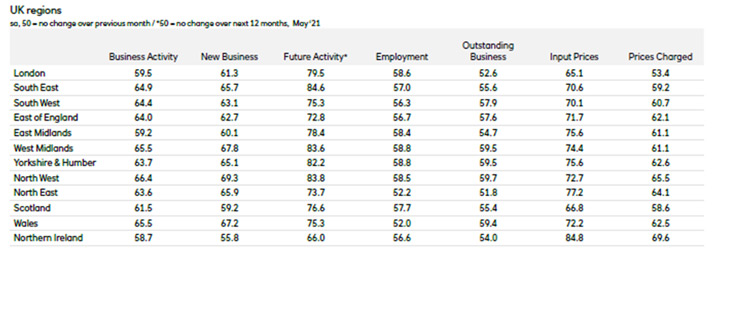

“But record highs of the negative variety were also on show with input cost inflation once again rising at a record rate. Manufacturers, retailers and construction firms also raised the prices of their goods and services at the fastest pace in the survey’s nineteen-year history. Across the UK, Northern Ireland firms continue to experience the most severe rates of inflation with firms invariably linking the increased costs and lengthening delivery times to Brexit paperwork.

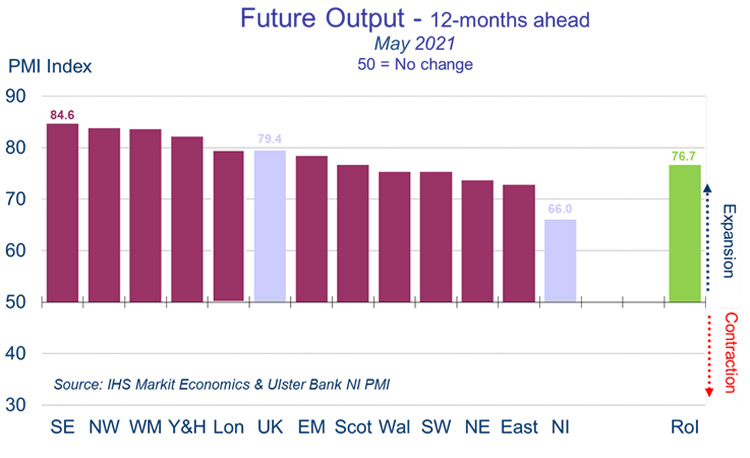

“The outlook is certainly improving with local firms the most optimistic about output in 12 months’ time in over three years and sentiment in manufacturing hitting a new survey high. Northern Ireland could well see a new high in output growth in the next month or two. Nevertheless, significant challenges remain. Global supply chain disruption and inflationary pressures, though expected to be transitory, will act as a headwind to the rapid recovery. Meanwhile as we saw last week, the continuing saga that is Brexit and the Northern Ireland Protocol, will be a source of political and economic turbulence for the foreseeable future.”

The May PMI report for Northern Ireland, the NatWest report for the UK regions and the Republic of Ireland’s Construction are attached for your information. Further PMI material including a chart pack, podcast and infographics are available at www.ulstereconomix.com