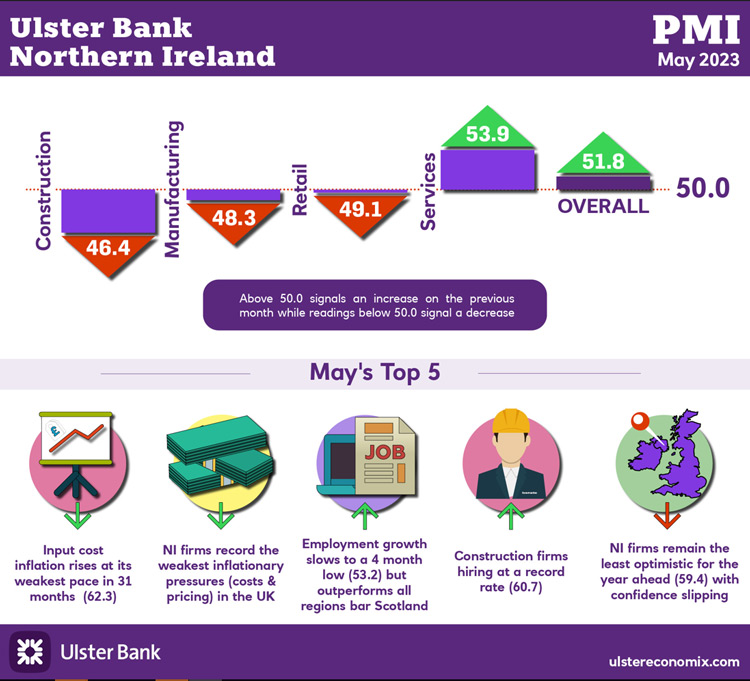

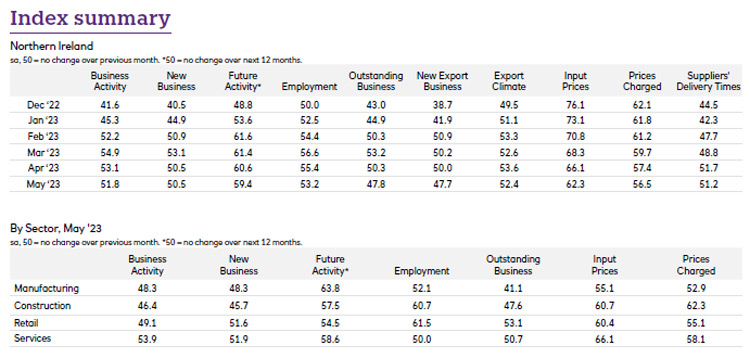

Today sees the release of May data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by S&P Global – signalled further growth in the Northern Ireland private sector midway through the second quarter of the year. Rates of expansion in output and employment showed signs of easing, however, while new orders increased at the same pace as in April. Also slowing were rates of inflation, with both input costs and output prices increasing to the least extent in around two-and-a-half years.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

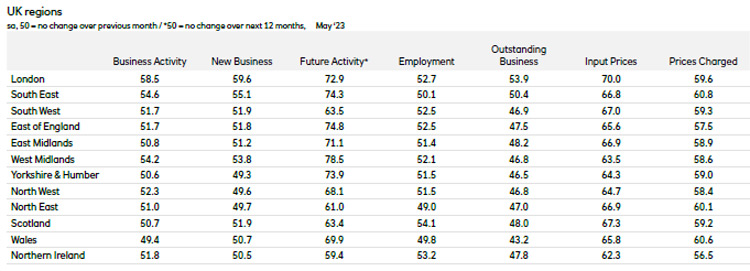

"NI’s private sector notched up its fourth successive month of growth in business activity in May, albeit it was the slowest rate of expansion in this sequence. Employment growth also eased to a four-month low but local firms increased their staffing levels at the fastest rate of all UK regions bar Scotland. New orders maintained the same modest rate of growth as April.

"A welcome slowdown was also evident in inflationary pressures, with input cost and output price inflation easing to its weakest level in around two-and-a-half years. It is encouraging to note that NI’s inflationary pressures are the least marked across the UK regions. There were some reports of energy prices coming down, with ongoing inflation linked to higher wages.

"In terms of sectors, services was the only one to record a rise in business activity in May, with construction and retail joining manufacturing in contraction territory. Services also posted the strongest rise in new orders, followed by retail. Retail’s recent purple patch of growth in sales and orders appears to have passed although retail is still recruiting hard. Meanwhile the slump in construction orders continued and is approaching two years of continuous decline. But again, construction firms are increasing staffing levels to address long-standing skills gaps.

"Encouragingly all four sectors expect growth in business activity in 12 months’ time, with manufacturing the most optimistic and retail the least. But firms said that hikes in interest rates and political stagnation have been impacting on growth and cuts in public expenditure are also a concern. None of these factors is expected to go away any time soon."

The May PMI report for Northern Ireland and the NatWest report for the UK regions are attached for your information. Further PMI material including a podcast and infographics are available at www.ulstereconomix.com