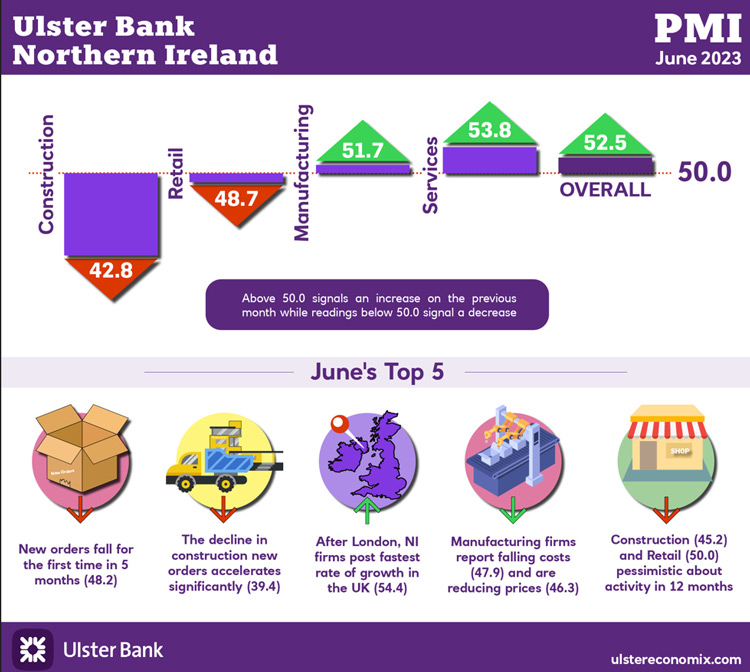

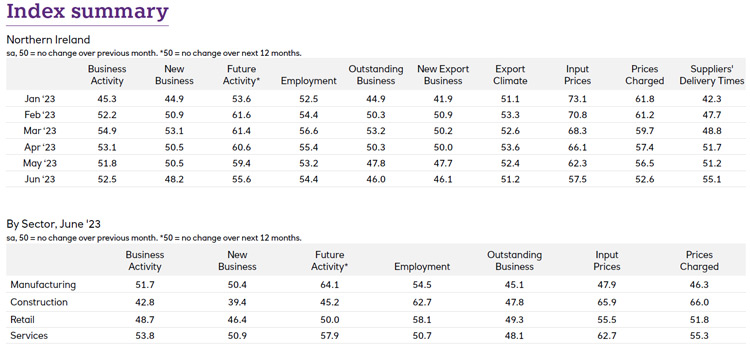

Today sees the release of June data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by S&P Global – indicated that companies raised activity again, despite a first reduction in new orders since January. Employment also continued to rise. Meanwhile, the recent slowdown in inflation continued at the end of the second quarter, with softer rises in both input costs and output prices recorded.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"NI’s private sector ended the second quarter with both output and employment accelerating. June represented the fifth successive month of output growth. It was encouraging to note that inflationary pressures continued to ease with input costs and output prices rising at the slowest pace in 33 and 32 months respectively. Where input costs did rise, it was linked to wage pressures. Meanwhile, manufacturing saw its input costs fall for the first time in over three years. The easing in inflationary pressures is being accompanied by another welcome development - a marked shortening in supplier delivery times, most noticeably within retail.

"The latest survey does highlight some challenges though. New orders fell for the first time in five months with firms citing a lack of public sector contracts as a factor. A two-speed economy is becoming increasingly evident. Manufacturing and services posted rising output and orders in June. However, retail, and even more so, construction, recorded notable declines in both of these indicators. These sectors have witnessed a notable deterioration in business confidence, with construction firms expecting business activity to be significantly lower in 12 months’ time, whereas retail businesses expect sales to be flat. Conversely, manufacturers and service sector firms still anticipate higher levels of activity in the middle of next year.

"It is not coincidental that the sectors most exposed to the lack of a NI Executive and the cost-of-living crisis – construction and retail respectively – are the ones that are the least optimistic. Construction firms in particular will be hoping we see a return to Stormont in the second half of this year, but there is no real prospect of the cost-of-living crisis dissipating in the remainder of 2023. Higher interest rates are also increasingly weighing on both business and consumer sentiment and this feature is expected to be with us for the foreseeable future too."

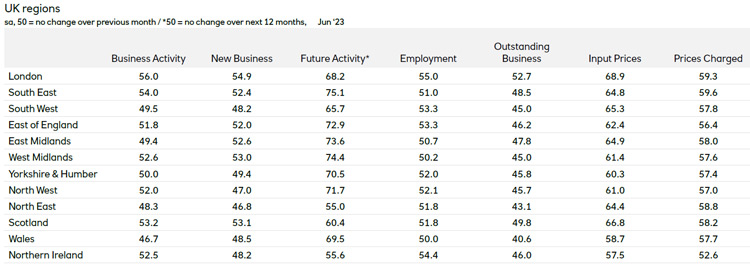

The June PMI report for Northern Ireland and the NatWest report for the UK regions are attached for your information. Further PMI material including a podcast and infographics are available at www.ulstereconomix.com