Activity increases, but new orders take a step back

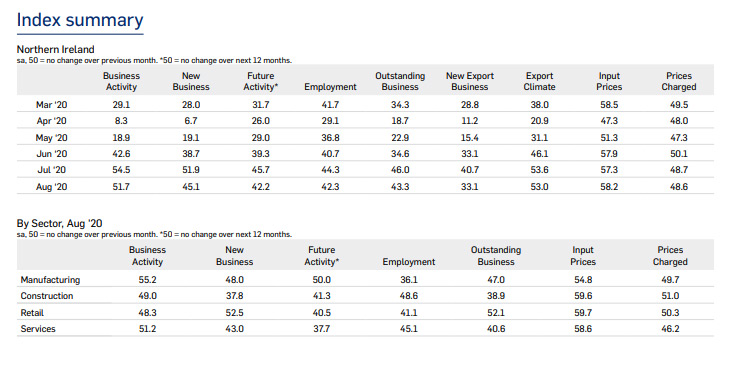

Today sees the release of August data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by IHS Markit – indicated that although business activity increased for the second month running, the rate of expansion softened amid signs of a stalling in the recovery in new orders. There remained further evidence of spare capacity, which led to a sharper reduction in employment. The rate of cost inflation quickened, but firms lowered their selling prices to try and attract new business.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

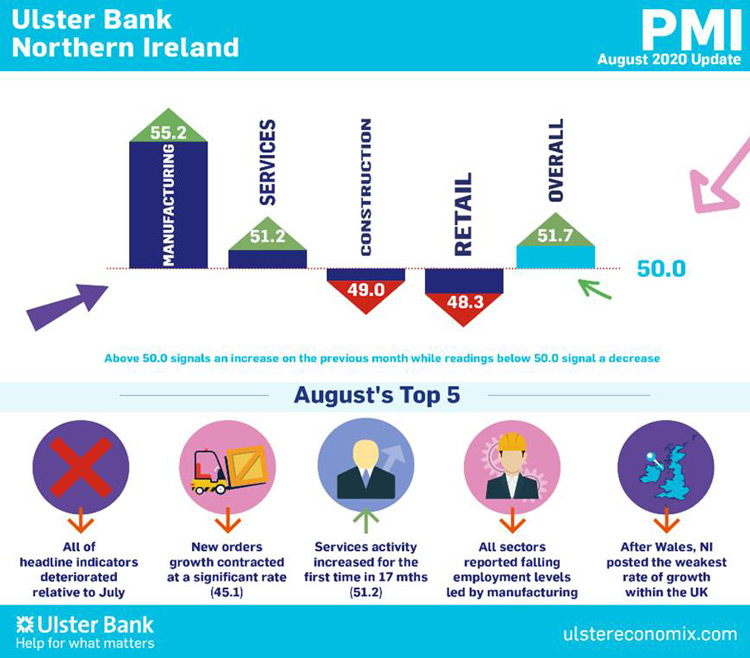

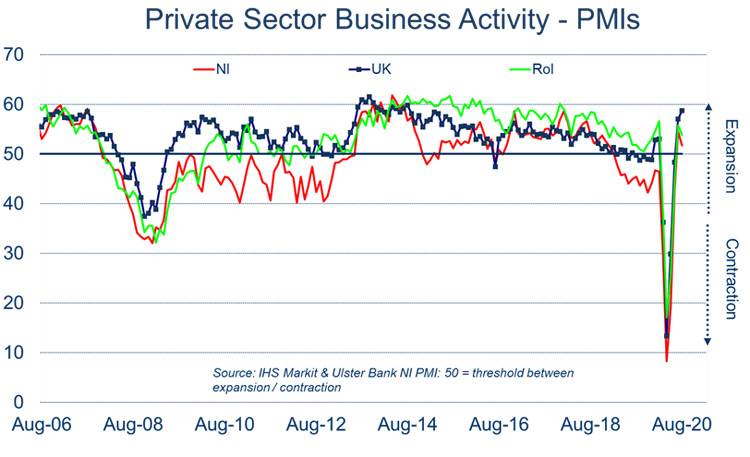

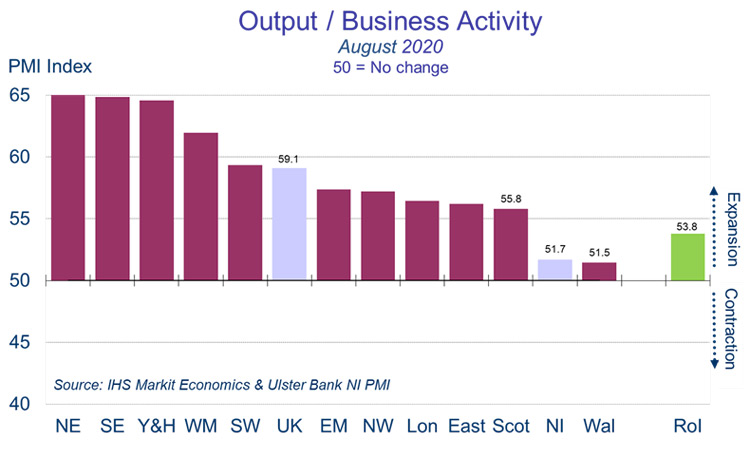

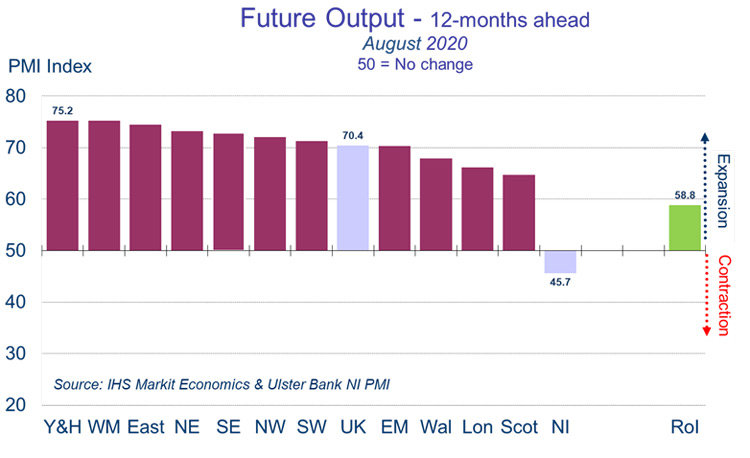

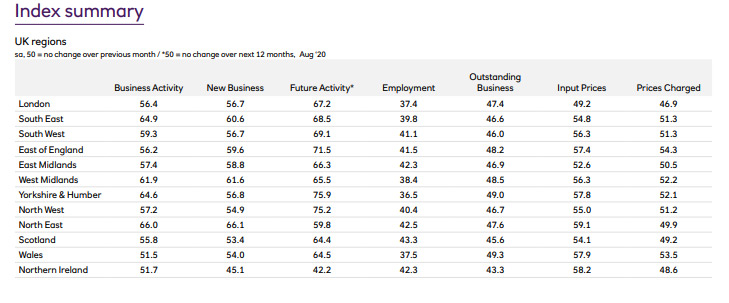

“PMIs in four English regions posted growth rates in the ‘60s’ in August, with the North East (66.0) and the South East (64.9) recording their fastest rates of growth on record. Hopes of a ‘V-shaped’ recovery remain intact in these regions; but the same is not the case in Northern Ireland. All of the headline indicators for Northern Ireland’s private sector deteriorated in August relative to July. Business activity slowed from an encouraging 54.5 in July to 51.7 last month. After Wales, this was the weakest rate of growth of any UK region. Interestingly, the Devolved Regions – who were more cautious in lifting lockdown restrictions – continue to lag their English counterparts.

“In Northern Ireland, both retail and construction saw activity fall back from July’s strong ‘reopening’ rebound. Meanwhile manufacturing notched up its third successive month of growth albeit at a weaker rate than July. Significantly, the local services sector saw its first month of growth since the pandemic started. However, the scale of the rebound was much weaker than anticipated despite the boost from initiatives such as the Eat Out to Help Out scheme. Indeed, Northern Ireland’s service sector recovery is lagging well behind the UK and is mirroring the lacklustre performance of the Republic of Ireland’s service industry.

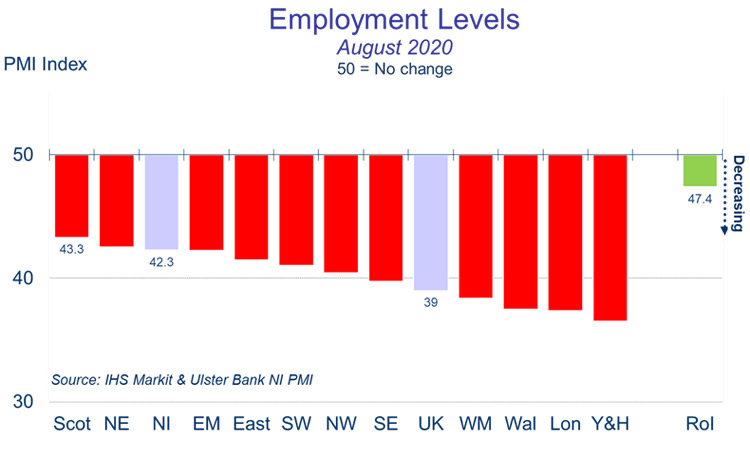

“While the recovery in output has at least begun, albeit not as rapid as had been hoped for, the start of a labour market recovery remains a long way off. Northern Ireland’s private sector saw employment fall for the sixth month running in August and with the furlough scheme due to end, this trend looks set to continue. All four sectors cut their staffing levels in August with manufacturing reporting the most significant reductions in headcount.

“Overall, Northern Ireland’s loss of momentum in August does not look temporary. New orders fell at a significant rate in August after rising in July for the first time in eighteen months with the rate of contraction most marked within export markets. The rise in the number of cases of COVID during September to date, combined with the heightened tensions surrounding Brexit, make the landscape a very challenging one.”

The August PMI report for Northern Ireland, the NatWest report for the UK regions and the Republic of Ireland’s Construction are attached for your information. Further PMI material including a chart pack, podcast and infographics are available at www.ulstereconomix.com