Business activity declines for tenth month running at end of 2019

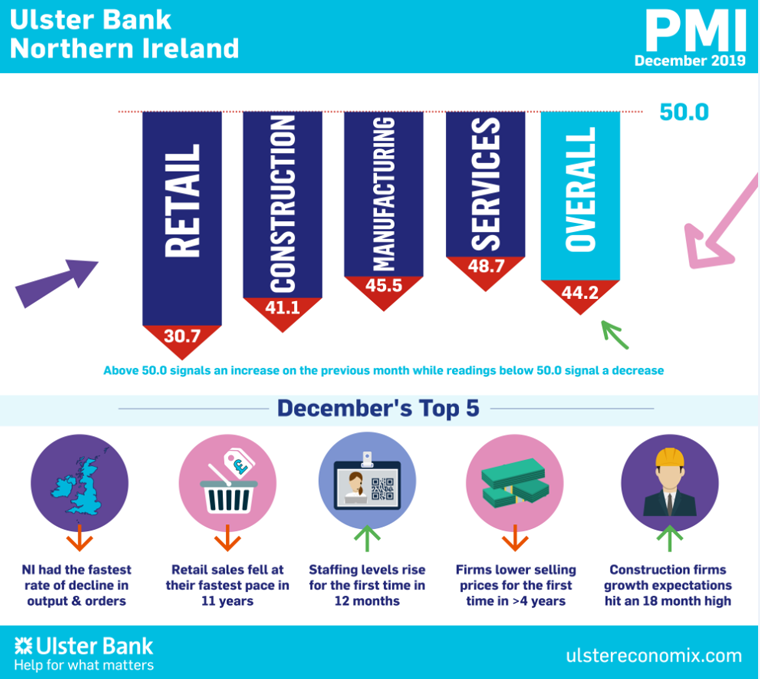

Today sees the release of December data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by IHS Markit – signalled further reductions in output and new orders, but rates of decline softened. Meanwhile, companies increased their staffing levels for the first time in a year and confidence regarding the 12-month outlook for activity improved amid reduced uncertainty around Brexit. On the price front, the rate of input cost inflation softened again and companies lowered their output prices for the first time in over four years.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

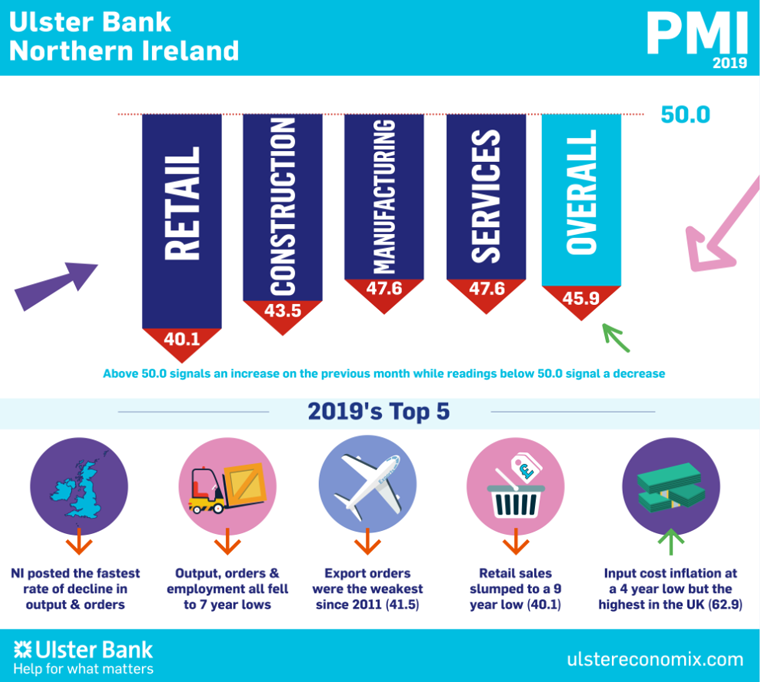

“Northern Ireland’s private sector ended the decade in the same manner as it began. Like 2010, last year was one of decline and underperformance albeit not as stark as the last deep recession. Local firms posted the fastest rates of contraction in output and orders of all the UK regions. 2019 was also the weakest year for private sector output, orders and employment growth in seven years. Meanwhile, export orders shrank at their fastest pace since 2011. Manufacturing and services firms posted their first annual fall in output since 2012. However, the pace of decline was more marked for both construction and retailers with the latter seeing sales slump to a nine-year low.

“While firms continued to report sharp rates of decline in output and orders in December and for the fourth quarter, there are some signs that Northern Ireland’s downturn is easing. Brexit uncertainty dogged private sector performance throughout 2019 but there has been a notable pick-up in sentiment in Q4. Greater clarity around Brexit and political direction following the General Election is a factor. All sectors have become more optimistic about the year ahead with retailers the only sector not anticipating growth over the next twelve months. Significantly, construction firms expect activity to increase over the next year for the first time in 18 months. December also revealed that staffing levels rose for the first time in 12 months. Though one indicator worth watching in the year ahead is profitability. Firms have reduced the prices of their goods and services for the first time since October 2015. This will squeeze profitability and put pressure on headcount if demand doesn’t pick up.

“Clearly signs of improvement are to be welcomed. However, significant challenges remain and Northern Ireland’s private sector has started 2020 in a weakened state. The lack of a Stormont Executive has been compounding matters, with its absence recently creeping into a fourth year. Restoring the institutions has been a political imperative but it is also essential for the economy and for the delivery of public services. Brexit uncertainty has eased and the extreme pessimism has receded. But uncertainty and potentially adverse consequences on this front remain.”

Key Quarterly Data for Q4 2019

- Business Activity, New Orders, Employment & Export Orders all posted 4 consecutive quarters of contraction

- Business Activity = 43.8 (lowest since Q4 2012 = 28 quarter low)

- New Orders = 42.5 (lowest since Q2 2012 = 30 quarter low)

- Employment = 49.4 (best quarter since Q4 2018)

- Exports = 40.3 (slightly better than Q3’s 31 quarter low)

Sectoral Business Activity / Output Q4 2019

- Manufacturing = 48.8 (Best quarter since Q1 2019 but third successive quarter of contraction)

- Services = 47.2 (Best quarter since Q1 2019 but third successive quarter of contraction)

- Construction = 38.8 (weakest quarter since Q4 2012 = 28 quarter lowand fifth successive quarter of contraction)

- Retail = 30.7 (weakest quarter since Q4 2008 and fifth successive quarter of contraction)

The December PMI report for Northern Ireland, the NatWest report for the UK regions and the Republic of Ireland’s Construction are attached for your information. Further PMI material including a chart pack, podcast and infographics are available at www.ulstereconomix.com