Business activity shows signs of stabilisation in March

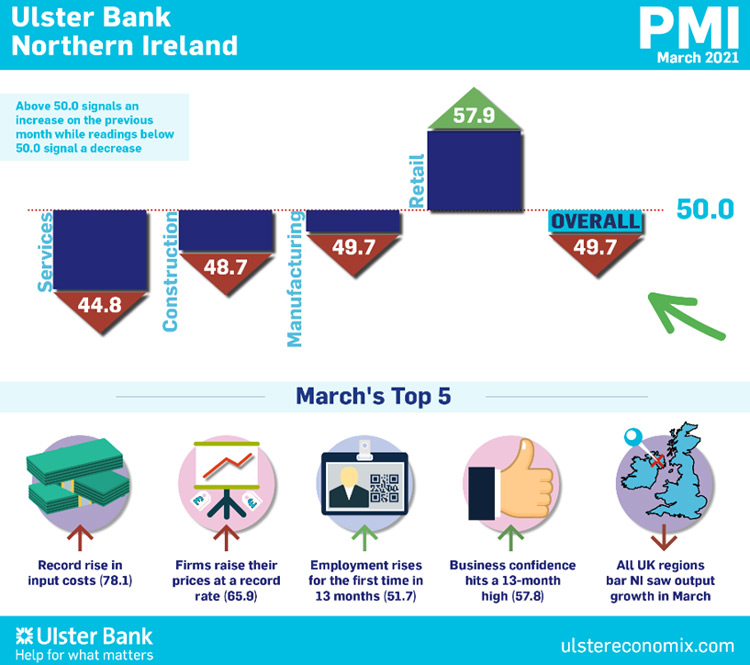

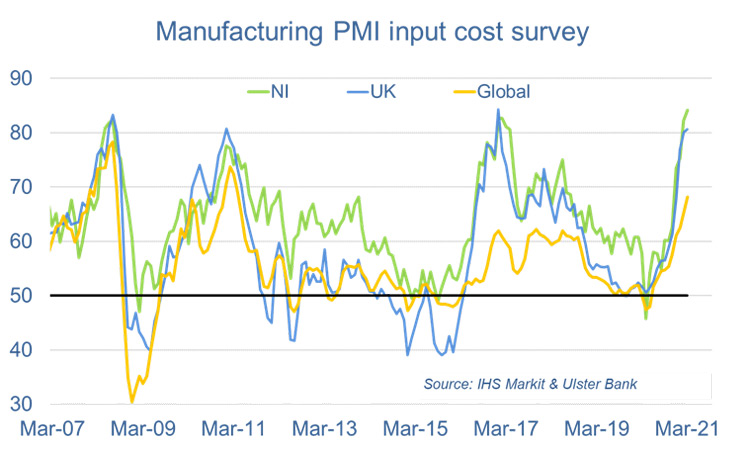

Today sees the release of March data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by IHS Markit – pointed to output and new orders nearing stabilisation, while employment increased amid growing confidence for the year-ahead outlook. That said, input costs and output prices surged at record rates, while there were widespread reports of supply delays.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

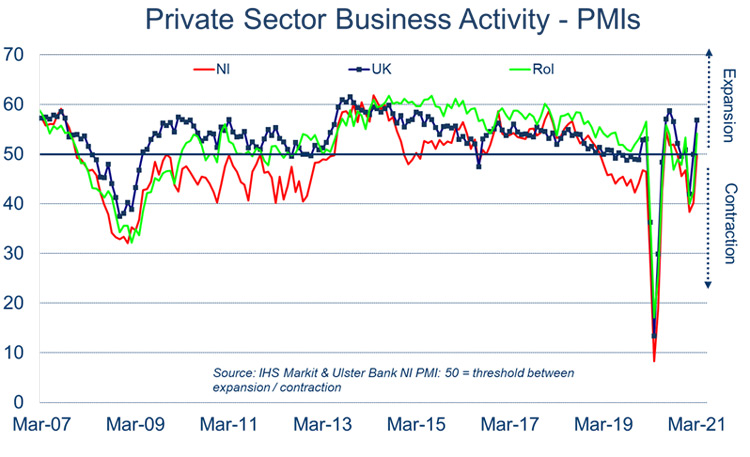

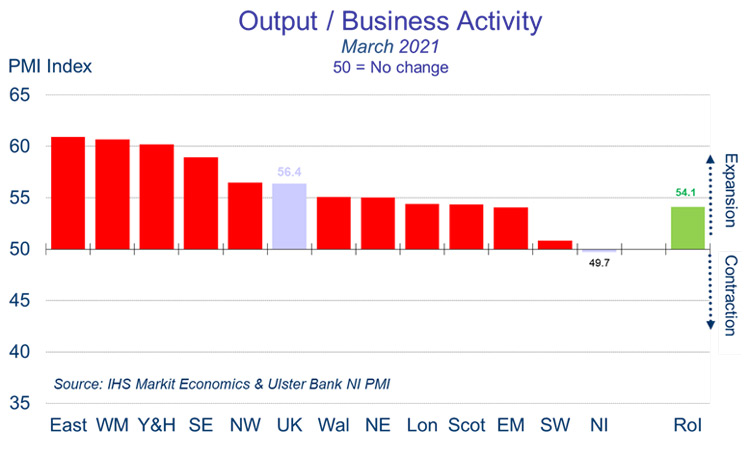

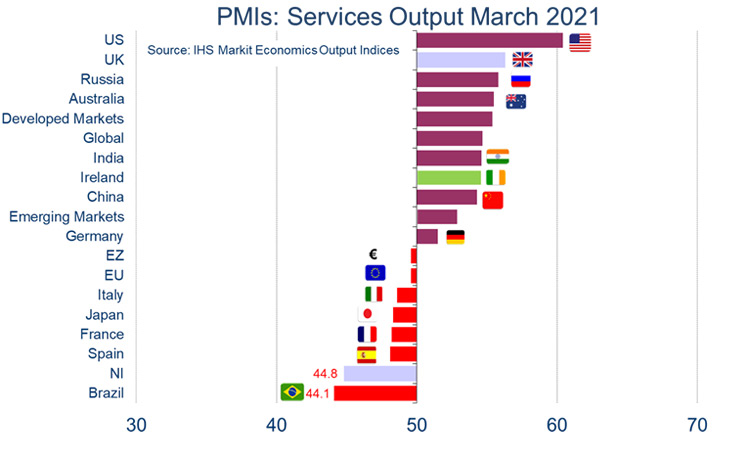

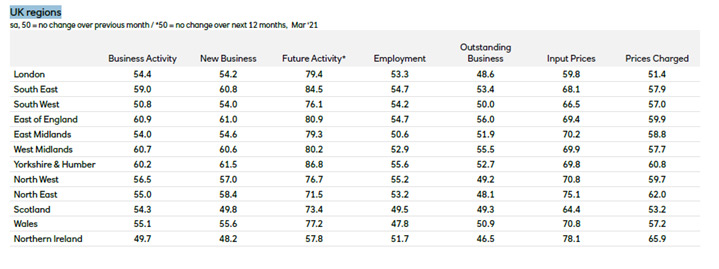

“Northern Ireland ended the first quarter of 2021 with output still falling, but only just. Northern Ireland though was the only region of the UK not to experience output growth in March. Whilst the rest of the UK has benefited some easing of lockdown restrictions, Northern Ireland still has this activity boost ahead of it.

“The local economy did see a bounce in retail activity last month, but this strong growth in both sales and new orders was coming off very weak levels. It is also encouraging to note that local firms increased their staffing levels for the first time in 13 months due to job creation in manufacturing and services. Whilst the latter is perhaps on the face of it surprising given the ongoing weakness of service sector output, anecdotally we have heard of hospitality businesses gearing up for reopening.

“Manufacturers will also be looking to the months ahead with more confidence given the improving conditions in key export markets. The Northern Ireland export climate index within the latest PMI improved markedly in March and this should filter through to increased demand over the next quarter.

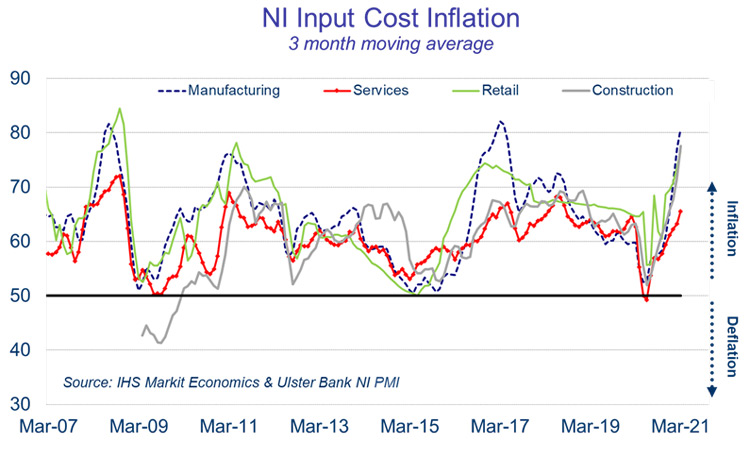

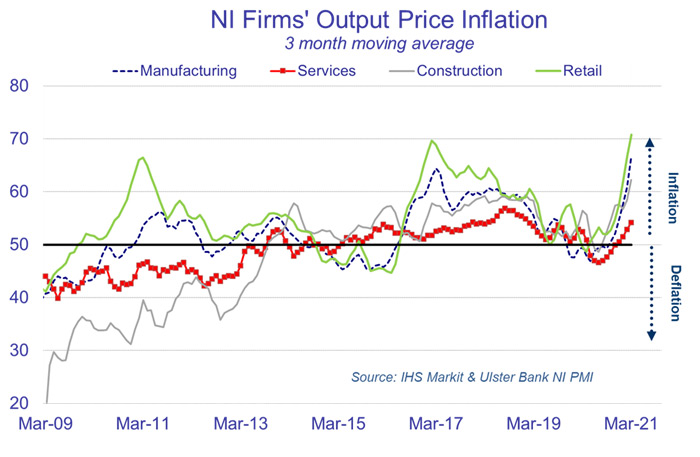

“However, the growing issue is inflation as firms grapple with significant rises in their input costs, driven by wage increases, rising freight costs and Brexit-related charges. Indeed, services was the only sector not to post record rates of cost increases. As a result, companies are increasing the prices of their goods and services at the highest rates in the survey’s history. Firms also reported severe supply chain delays, which is unsurprising given Brexit-related challenges, alongside the temporary blockage of the Suez Canal.

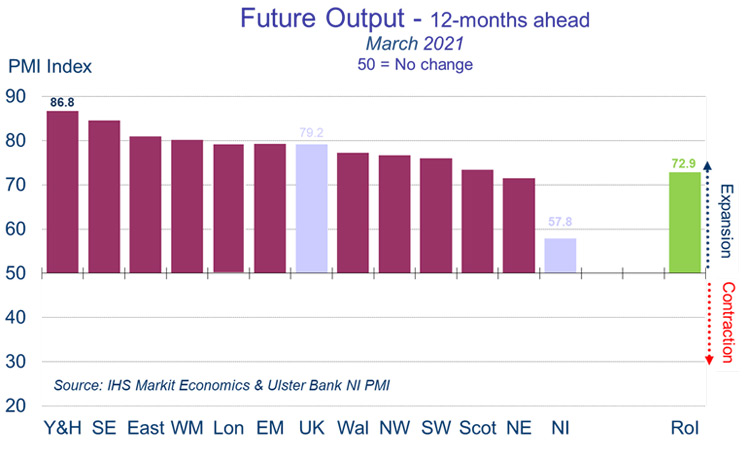

“But whilst there are still significant challenges, the 12-month outlook improved due to increased confidence in the manufacturing and services sectors. With construction and retail still relatively pessimistic, though, Northern Ireland overall lags the rest of the UK by a significant margin in terms of sentiment. And what confidence there is could be dented by the current political situation, and there is a risk that this could be a head wind for the recovery.”

The March PMI report for Northern Ireland, the NatWest report for the UK regions and the Republic of Ireland’s Construction are attached for your information. Further PMI material including a chart pack, podcast and infographics are available at www.ulstereconomix.com