Export orders fall at their fastest pace in 69 months

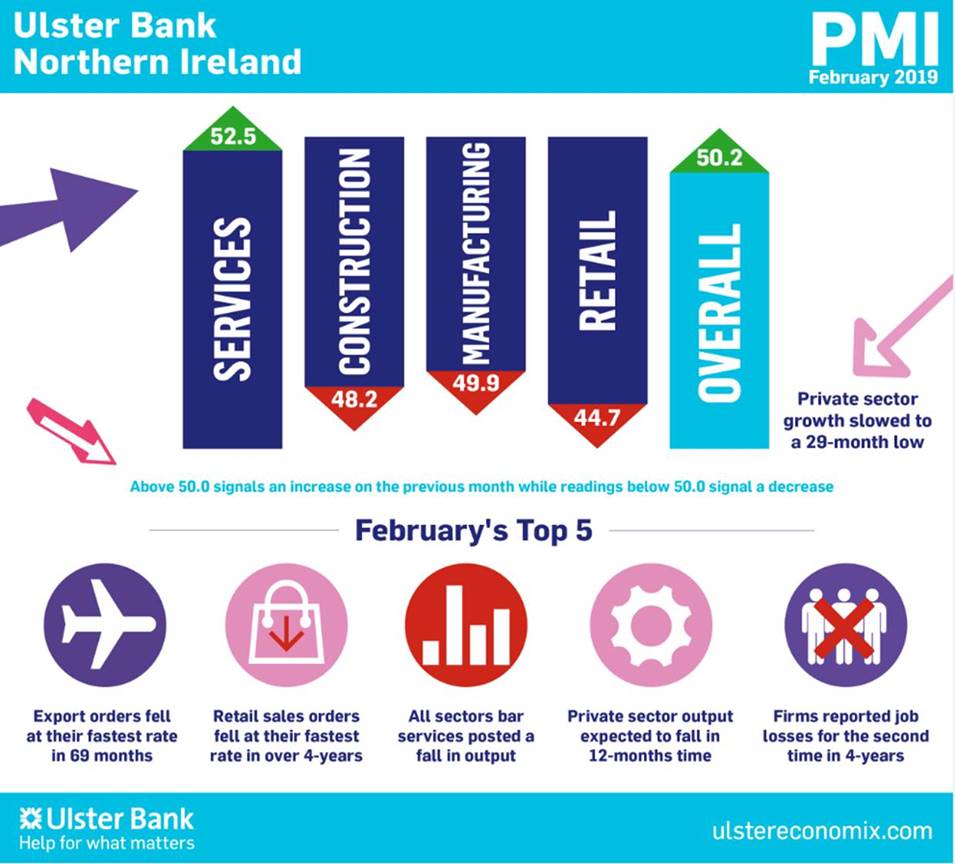

Today sees the release of February data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by IHS Markit – signalled that business activity in Northern Ireland rose only fractionally in February. The near-stagnation in output reflected Brexit worries, with total new orders falling for the first time in 28 months, new export business down sharply and business sentiment turning negative. Meanwhile, companies lowered their staffing levels for the second month running.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

“February’s PMI marked the final survey before the Brexit withdrawal date, and last month was perhaps the point of peak uncertainty and fear regarding a potential ‘no-deal exit' from the EU. This uncertainty is very much reflected in the latest report.

“Private sector firms saw a marked deterioration in business conditions, with output growth almost grinding to halt, employment falling, new orders decreasing, and export orders falling at their fastest pace in 69 months.

“In terms of output, private sector growth eased to a 29-month-low, with services being the only sector to remain in expansion mode. Manufacturing output stagnated but both construction and retail saw rapid rates of decline.

“Indeed, retail sales fell at their fastest rate in almost four years and this trend looks set to continue with orders falling at their fastest rate in 49-months. And, as with output, services was the only sector to record a rise in new orders, albeit the pace of growth remains relatively modest.

“In relation to employment, Northern Ireland was one of nine UK regions to experience a fall in February, driven by the services sector which had until January seen almost two-and-a-half years of growth. But the one area where Northern Ireland stands out against the rest of the UK is confidence in the year ahead. Northern Ireland is the only UK region where firms expect business output to be lower in 12-months’ time.

“Whilst Brexit uncertainty is clearly a factor in all of this, it should be remembered that there are other factors at play, including the wider economic slowdown across Europe, concerns over global trade, and the ongoing restructuring of the retail sector.”

The February PMI report for Northern Ireland. Further PMI material including a chart pack, podcast and the NatWest report for the UK regions (due to be published on 12th March) will be available at www.ulstereconomix.com.