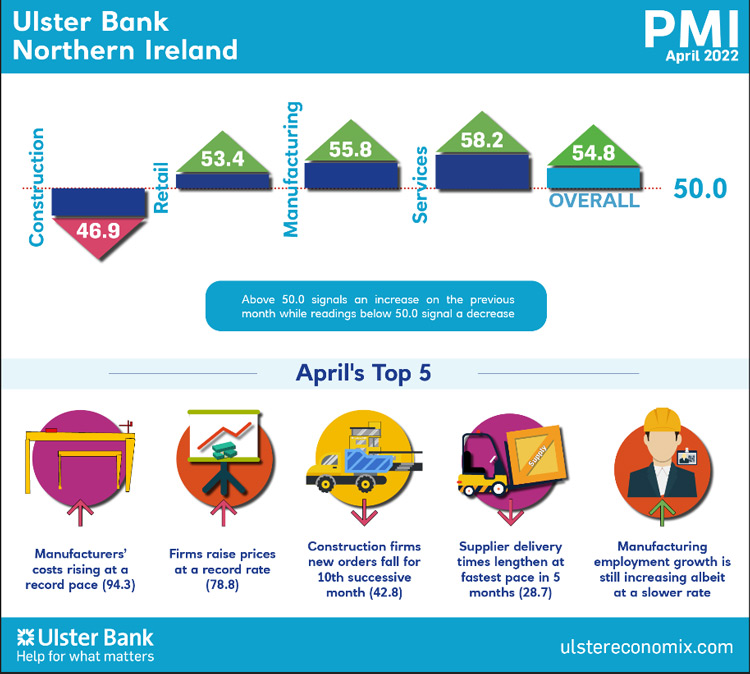

New order growth slows amid substantial price pressures

Today sees the release of April data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by S&P Global – indicated that substantial inflationary pressures acted to subdue growth of output and new orders, with the rate of job creation also easing at the start of the second quarter.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

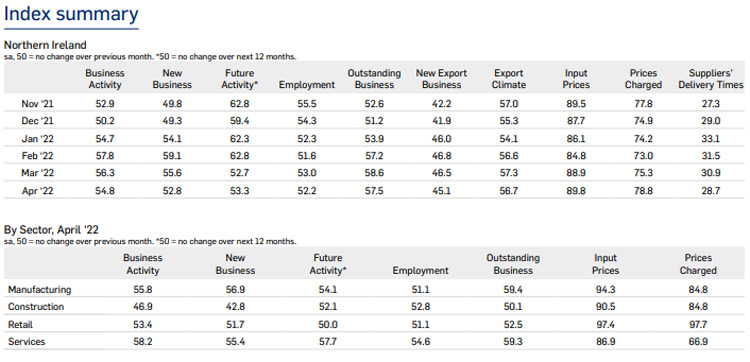

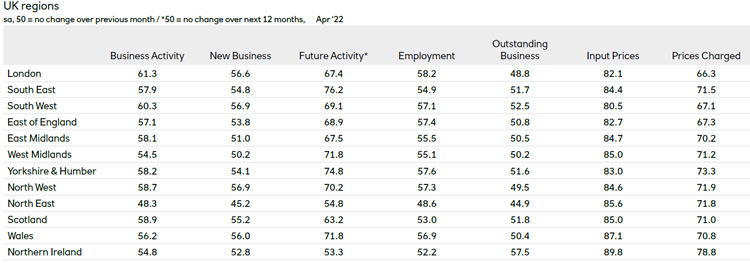

“Lockdowns across China and the war in Ukraine, caused economic forecasts to be slashed around the world last month. Slower rates of growth and higher rates of inflation are par for the course across the PMI surveys in April too. Northern Ireland was no exception with firms reporting slower rates of growth in output, new orders and employment. Conversely, input costs rose at their second highest rate on record while firms raised the prices of their goods and services at the fastest pace since the survey began almost 20 years ago. Indeed, inflationary pressures continue to be more intense in Northern Ireland than in all other UK regions.

“Manufacturing continued in expansion mode in April but there was a substantial slowdown in output and new orders growth. Meanwhile, manufacturers saw the pace of employment growth slow to a 14-month low as difficulties finding suitable staff continue. Services firms bucked the wider slowdown by reporting faster rates of growth in new orders and employment in April. Once again, construction reported a fall in output and a sharp decline in incoming orders.

“Manufacturing and services are running into capacity constraints. Skills shortages, coupled with strong demand have resulted in backlogs mounting at rapid rates. Services firms are seeing outstanding workloads rise at their fastest paces since 2013. Lengthening supplier delivery times are adding to these difficulties. These backlogs should guarantee relatively strong rates of growth in business activity in the near term but optimism for the year ahead remains relatively muted with the cost-of-living crisis making retailers the least optimistic for the year ahead. With the economy set to deteriorate in the second half of the year, the business community will be hoping for a quick formation of a Northern Ireland Executive to help deal with short term challenges and to progress much needed long-term reforms and investment.”

The April PMI report for Northern Ireland and the NatWest report for the UK regions are attached for your information. Ulster Bank no longer sponsors the Republic of Ireland Construction PMI. BNP Paribas have taken over this survey. To be included on its distribution list please contact ellen.browne@bnpparibas.com

Further PMI material including a podcast and infographics are available at www.ulstereconomix.com