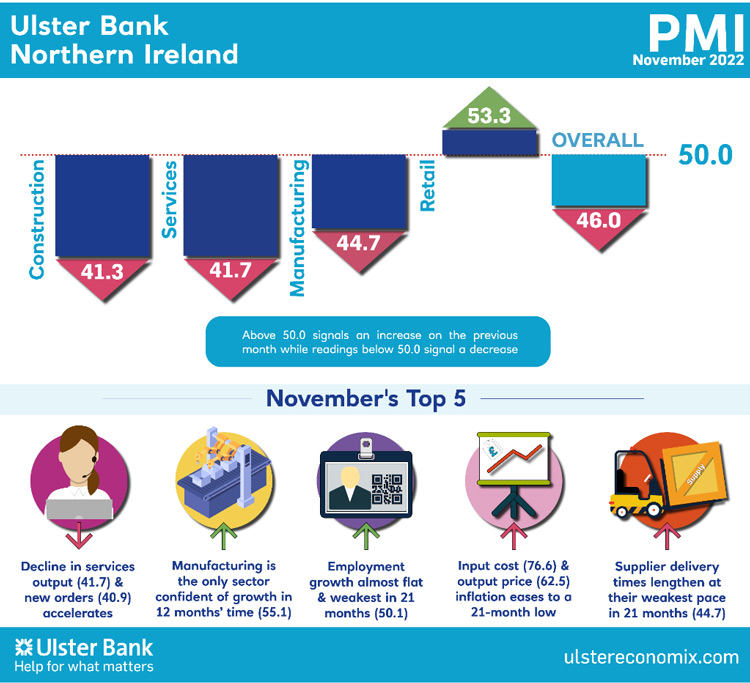

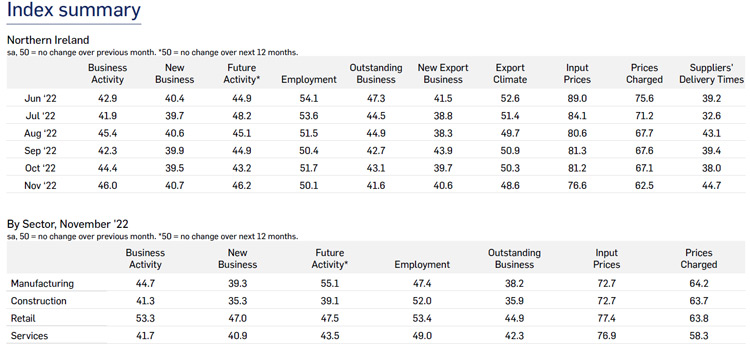

Today sees the release of November data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by S&P Global – showed that inflationary pressures and a wider economic slowdown led to further reductions in output and new orders in the Northern Ireland private sector. There were further signs, however, of inflation softening as both input costs and selling prices rose at the weakest rates in 21 months.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

"Once again, all 12 UK regions witnessed a decline in private sector activity in November. Northern Ireland notched up its seventh successive monthly fall in output, albeit the pace of decline slowed. More concerning though was that the pace of contraction in new orders was more marked, with all four sectors experiencing weakening demand.

It may seem surprising to see a rebound in retail activity, but the rise in sales is coming off the back of months of declines. There is also perhaps an element of consumers enjoying a last hurrah for Christmas ahead of a challenging 2023. Indeed, when we look at the outlook, retailers are expecting their sales to be lower in 12 months. The opposite was the case for manufacturing, which experienced a sharp reduction in both output in orders during November, but manufacturers are optimistic about the outlook. This perhaps reflects the nature of the current recession with households and consumer sensitive businesses likely to experience a longer and deeper downturn than global exporters.

One key source of positivity has been the 20 consecutive months of employment growth but this almost ground to a halt in November largely due to falling staffing levels in services and manufacturing. Ongoing difficulties recruiting suitable staff though remains a factor rather than falling demand alone. That dynamic will likely continue into 2023, with firms continuing to suffer from skills shortages, however falling demand will increasingly come to the fore.

Overall, the local private sector is coming to the end of 2022 in a weakened state, with 2023 likely to be a very challenging year. One silver lining is that inflationary pressures do though seem to be easing, with input costs and output price inflation rising at their lowest rates in 21 months. With energy prices falling back, easing inflation, alongside less supply chain disruption, will be amongst the few positives during 2023."

The November PMI report for Northern Ireland and the NatWest report for the UK regions are attached for your information. Ulster Bank no longer sponsors the Republic of Ireland Construction PMI. BNP Paribas have taken over this survey. To be included on its distribution list please contact ellen.browne@bnpparibas.com

Further PMI material including a podcast and infographics are available at www.ulstereconomix.com