New orders fall sharply again in July

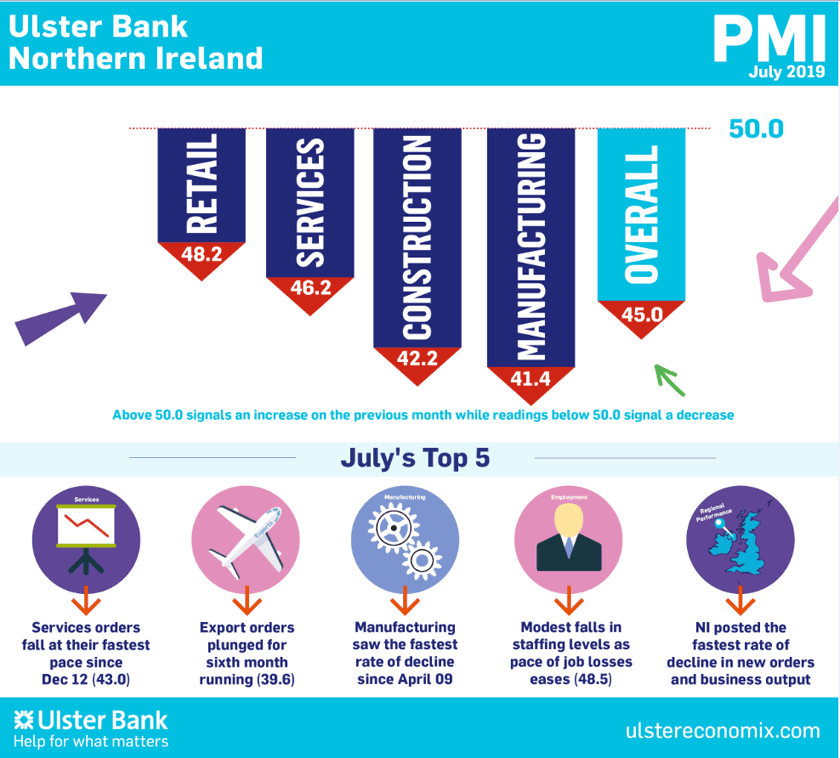

Today sees the release of July data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by IHS Markit – indicated that sharp falls in output and new orders were recorded again amid ongoing worries around the final Brexit outcome. Employment also continued to decrease, while sentiment remained weak. On the price front, input costs increased at a sharp pace, while output price inflation quickened to a five-month high.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

“Northern Ireland’s private sector reported a marked deterioration in business conditions in the second quarter. July’s PMI survey suggests more of the same at the start of the third quarter as output, orders, exports and employment continued to fall last month. The rate of decline across all of these indicators did ease in July relative to June. However, the pace of contraction in output, orders and exports remained significant with output and orders falling at a faster rate than in any other UK region.

“Firms notched up their seventh successive monthly fall in staffing levels; albeit the pace of job losses in the latest survey was relatively modest. Indeed, a number of respondents’ efforts to hire were thwarted by a lack of suitable staff. Clearly the lack of supply of workers remains a key issue in the labour market rather than simply waning demand.

“It won't surprise anyone to hear that 2019 has been a year of decline for the retail sector. However, there are actually now some signs that the rapid decline in sales is stabilising. Given the further depreciation in sterling, cross-border shopping is likely to play a more prominent role in the period ahead.

“Manufacturing has seen a sharp reversal of fortunes in recent months with the sector posting the sharpest rates of decline in jobs, orders and output of the four sectors. Last month manufacturers reported their steepest fall in output since April 2009. The ongoing fog of Brexit uncertainty is one contributory factor alongside a global manufacturing slowdown.

“Elsewhere, services firms, outside of retail, recorded a deterioration in business conditions in July. Significantly, services orders have been falling at an accelerating rate in each of the last five months. Indeed, July saw orders contract at the fastest rate in over six-and-a-half years. It is a similar story for the construction industry with orders lurching lower again for the eleventh month running.

“The employment picture remains the most positive aspect of the latest survey. But it is well known that the labour market is a lagging indicator of economic conditions. Shrinking order books, Brexit uncertainty and the ramping up of tensions between China and the US provide a formidable environment for local firms. Business conditions could well get worse before they start getting better.”

Please view the The July PMI report for Northern Ireland and the NatWest report for the UK regions. Further PMI material including a chart pack, podcast and infographics are available at www.ulstereconomix.com