New orders stagnate in December

Today sees the release of December data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by IHS Markit – pointed to no change in new orders at the end of 2018. Meanwhile, business activity and employment continued to rise solidly, albeit at weaker rates than in November. Both input costs and output prices increased at marked rates again, but inflationary pressures showed some signs of easing at the end of the year.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

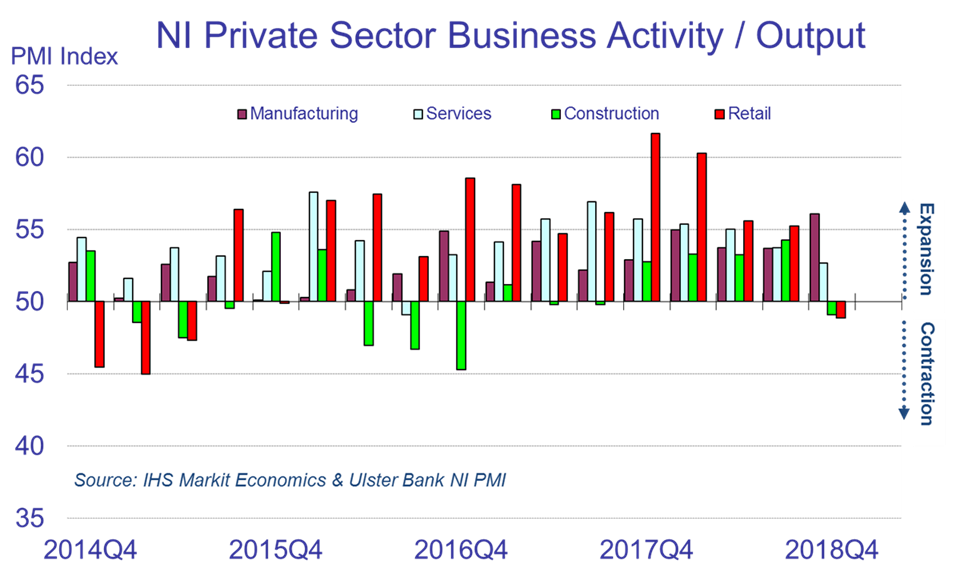

“According to the PMI surveys, Northern Ireland was the second fastest growing region in the UK in Q4 2018; although it should be noted that Q4 was Northern Ireland’s weakest quarter for growth in output and new orders in nine quarters. Manufacturing remains the star performer with output and employment growth accelerating in Q4. Indeed, December saw manufacturing firms grow their staffing levels at the fastest rate in over three-and-a-half years, and the last quarter marked the fastest rate of manufacturing output growth in over four years. Elsewhere the theme is one of slower or subdued growth and decline. Service sector output decelerated in each of the last five quarters with the latest period the slowest rate of growth in nine quarters.

“Meanwhile construction and retail posted outright declines in activity/sales in Q4. Construction orders continue to fall and not surprisingly, given the logjam of public sector projects, construction firms expect activity to be even lower in 12-months’ time. Northern Ireland may have climbed the regional rankings for output growth but remains rooted to bottom spot for future output, in 12- months’ time. While construction firms are the most pessimistic, retailers’ confidence for the year ahead has also fallen to new lows. Indeed, the fact that new orders stagnated in Northern Ireland’s private sector in December doesn’t bode particularly well for the start of 2019. Services firms saw orders fall for the first time in 26 months and construction orders fell for the fourth month running. On a slightly more positive note, export orders picked up marginally in December, albeit that growth remained modest. Perhaps more significantly, inflationary pressures eased in December with input costs rising at their weakest pace since August 2017. Indeed, retailers and manufacturing firms are seeing their costs rise at the slowest pace in more than two-and-a-half years. That said, Northern Ireland continues to have the highest rate of input cost inflation in the UK.”

The December PMI report for Northern Ireland and the NatWest report for the UK regions are attached for your information. Further PMI material including a chart pack, podcast and infographics are available at www.ulstereconomix.com.