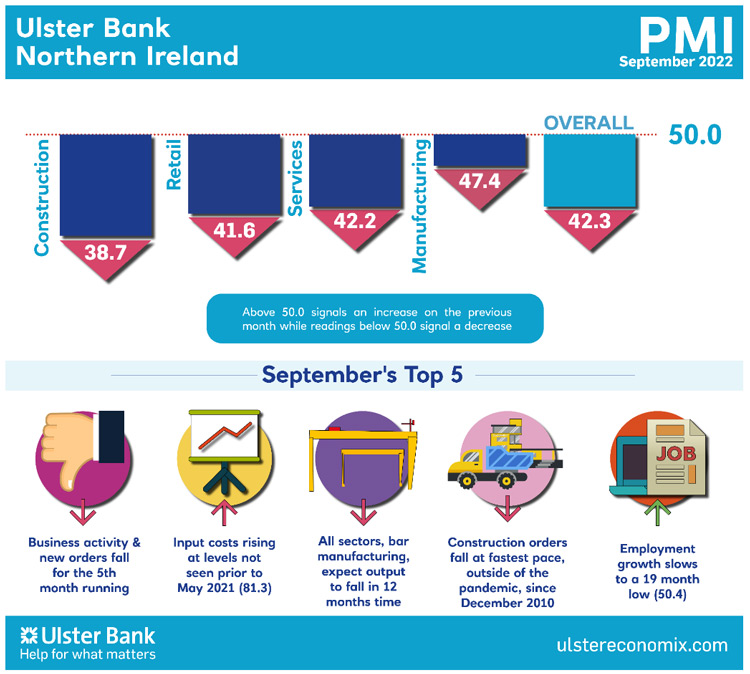

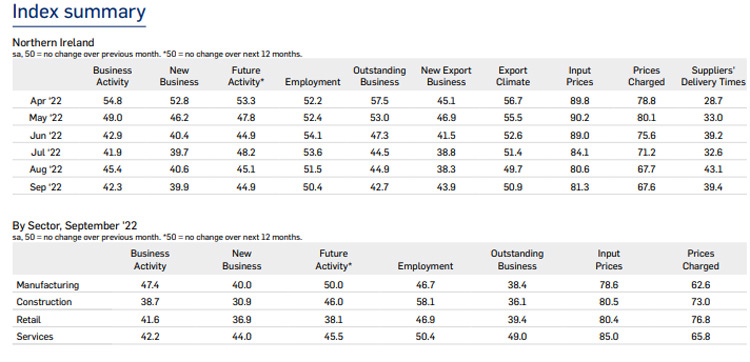

Today sees the release of September data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by S&P Global – saw the third quarter of 2022 end with the Northern Ireland private sector remaining deep inside contraction territory. Rates of decline in output and new orders quickened and while employment continued to rise the latest round of job creation was only marginal.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

“‘Going for growth’ is the Chancellor’s new approach for his new era, but contraction was very much to the fore in the September PMIs in Northern Ireland, across the UK and indeed beyond. And this was before the turbulence that the Chancellor’s ‘mini budget’ caused, which doesn’t bode well for the rest of the year.

“Local firms saw the pace of decline in output and new orders accelerate in September, which represented the fifth successive monthly fall with all four sectors firmly in contraction mode.

“Survey respondents cited deteriorating economic conditions, falling consumer confidence and rising prices as explanatory factors behind the continuing decline.

“Input costs continued to rise at a substantial rate and are at levels not seen prior to May 2021. Services firms reported the sharpest increases in their cost base, with wages and energy costs now increasingly at the forefront of inflationary pressures.

“The one positive in the latest report is employment with firms notching up their 19th consecutive monthly rise in staffing levels. However, the pace of employment growth was the weakest in that sequence and manufacturing saw the first decline in staff numbers since February 2021. The slowdown in hiring is currently linked to difficulties finding suitable staff rather than just reflective of falling demand. However, the expected further reductions in business activity will no doubt weigh more on hiring intentions in the months ahead.

“We have started the fourth quarter of the year with heightened uncertainty, not least in financial markets and in politics. Firms may be relieved to see energy cost pressures easing, accompanied by much needed government support. But borrowing costs have now moved rapidly in the opposite direction. It’s hard to see the Chancellor’s much desired growth coming any time soon.”

The September PMI report for Northern Ireland and the NatWest report for the UK regions are attached for your information. Ulster Bank no longer sponsors the Republic of Ireland Construction PMI. BNP Paribas have taken over this survey. To be included on its distribution list please contact ellen.browne@bnpparibas.com

Further PMI material including a podcast and infographics are available at www.ulstereconomix.com