Output continues to rise, but rate of growth eases to four-month low

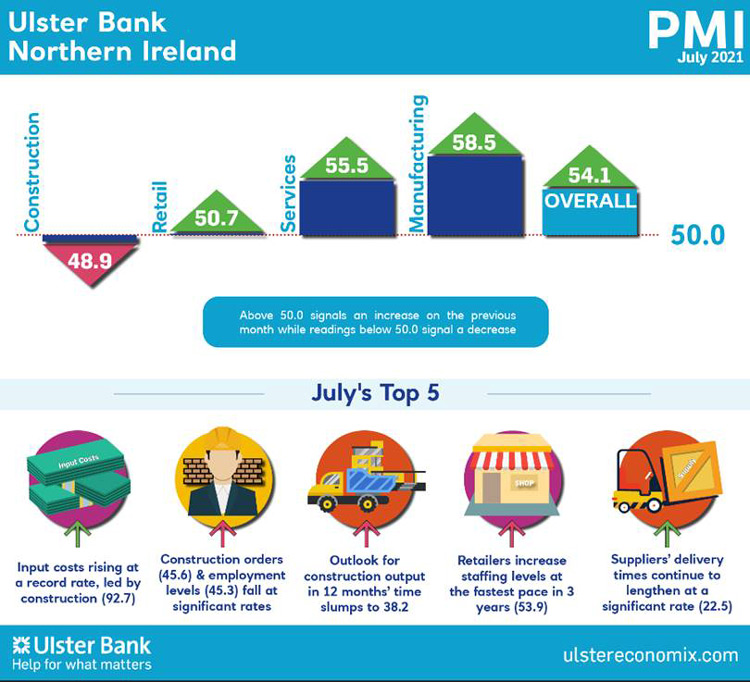

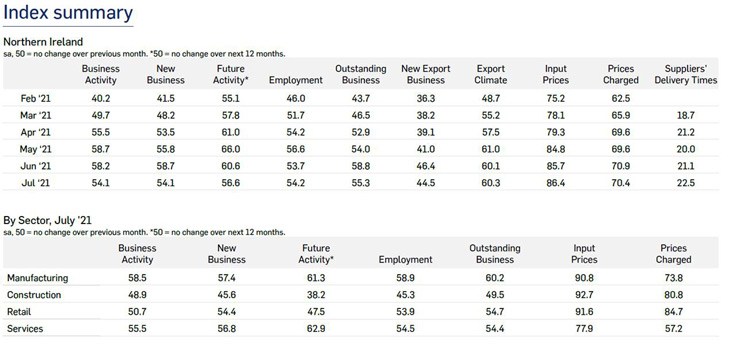

Today sees the release of July data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by IHS Markit – pointed to further increases in output and new orders, although rates of expansion eased from June. The rate of job creation accelerated, while inflationary pressures remained elevated.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

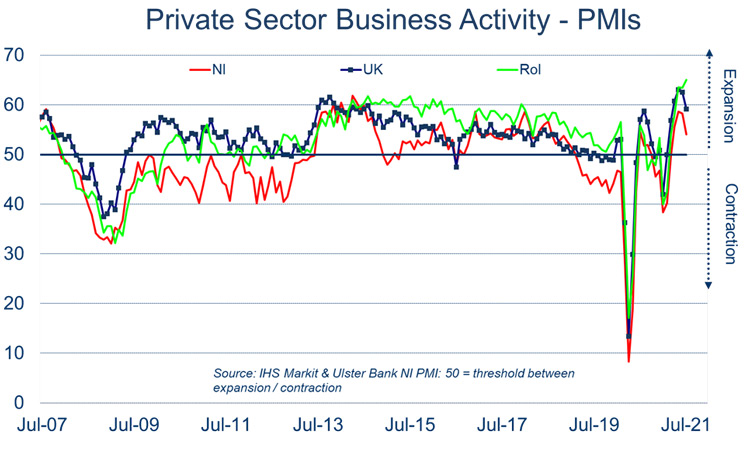

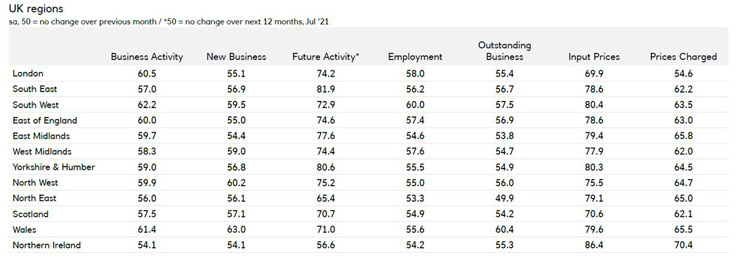

“Northern Ireland’s private sector started the third quarter with its fourth successive month of output growth. However, the pace of growth eased in July in common with nine other UK regions. A moderation in the rate of expansion was expected following the boost to activity in earlier months that followed an easing of lockdown restrictions. Nevertheless, Northern Ireland firms posted the slowest rate of output and new orders growth in July amongst the 12 UK regions.

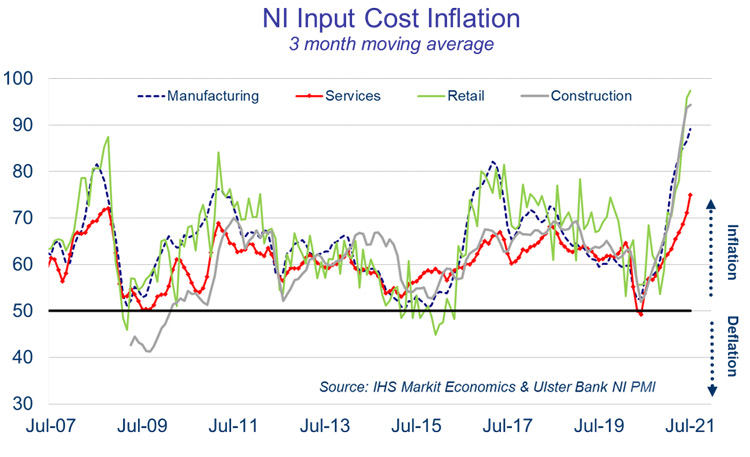

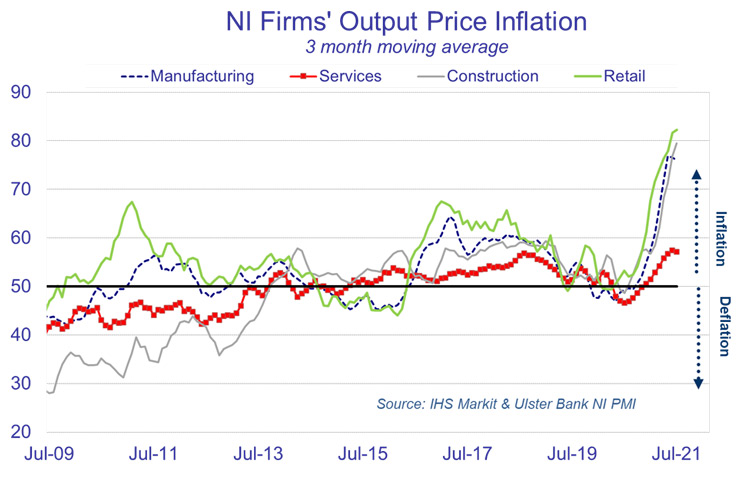

"Employment was one of the few headline indicators to record an improvement last month with the pace of job creation quickening due to a pick-up in hiring within retail and manufacturing. Meanwhile inflationary pressures continued to intensify with local firms reporting a record rise in input costs for the fifth successive month. Manufacturing, construction and retail all experiencing extreme input cost inflation with PMI readings of over 90. Northern Ireland’s private sector rates of inflation were once again higher than in any other UK region. Alongside cost pressures, supply-chain disruption remains a major challenge for businesses. Bureaucracy related to Brexit was the most frequently cited reason for a further lengthening in delivery times.

"In some respects, there is a three-speed recovery happening, with manufacturing and services continuing to record robust rates of growth in output and new orders. Retailers however, recorded slower rates of growth across these measures whilst the construction industry has seen its performance go into reverse. Output, new orders and employment within the construction industry all contracted in July with very steep rates of decline in incoming work and staffing levels. These difficulties within construction are linked to severe cost increases and supply-chain difficulties which have triggered a slump in confidence within the sector. Both construction and retail expect activity to be lower in 12 months’ time. However, services and manufacturing firms remain optimistic and expect strong growth in the year ahead."

The June PMI report for Northern Ireland, the NatWest report for the UK regions and the Republic of Ireland’s Construction are attached for your information. Further PMI material including a chart pack, podcast and infographics are available at www.ulstereconomix.com