Output continues to rise modestly at end of third quarter

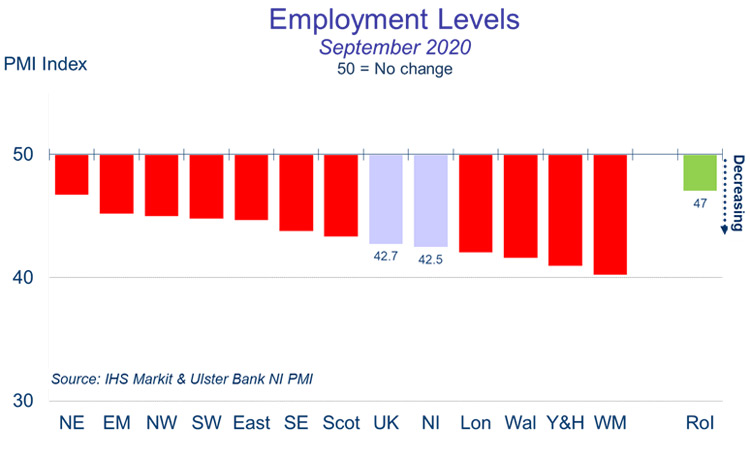

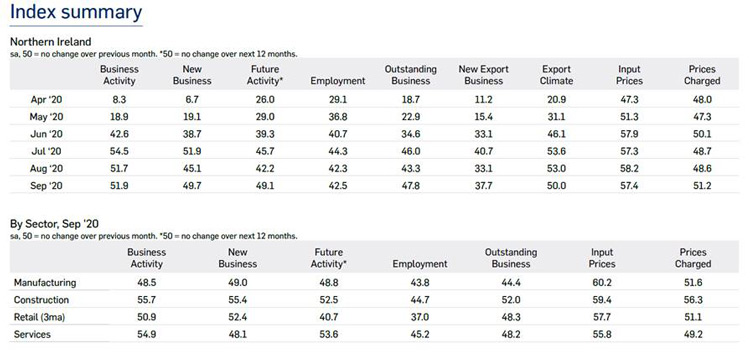

Today sees the release of September data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by IHS Markit – showed that business activity continued to increase as new orders broadly stabilised. That said, sharp reductions in employment were recorded again. On the price front, companies raised their charges for the first time in three months in response to higher input costs.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

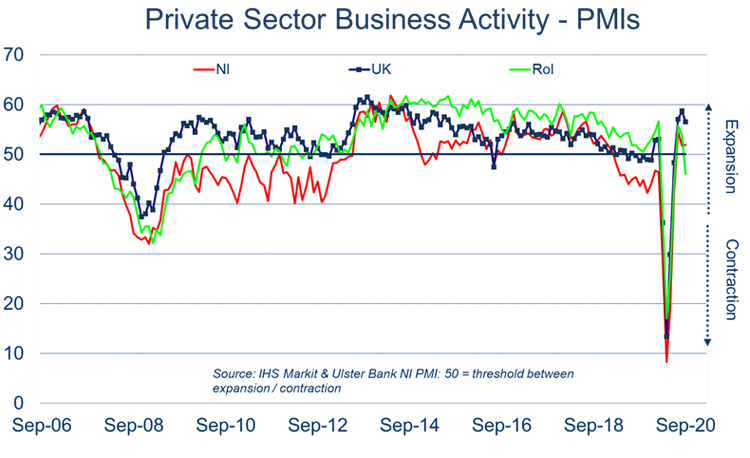

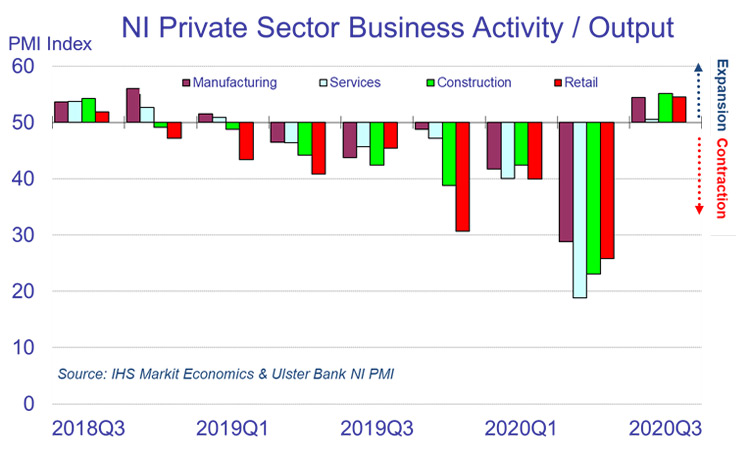

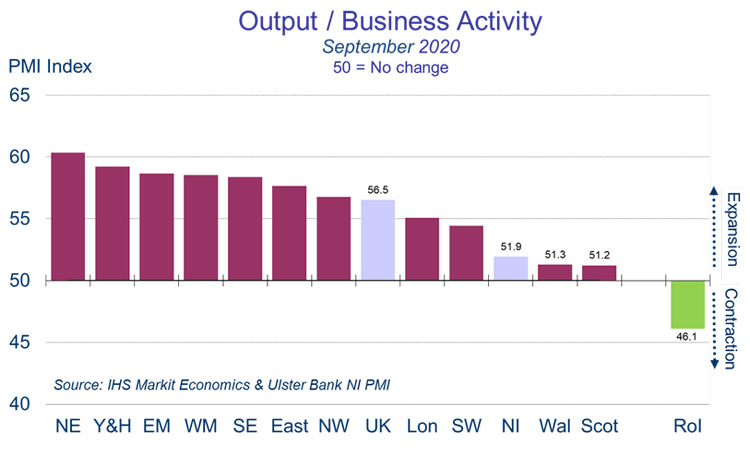

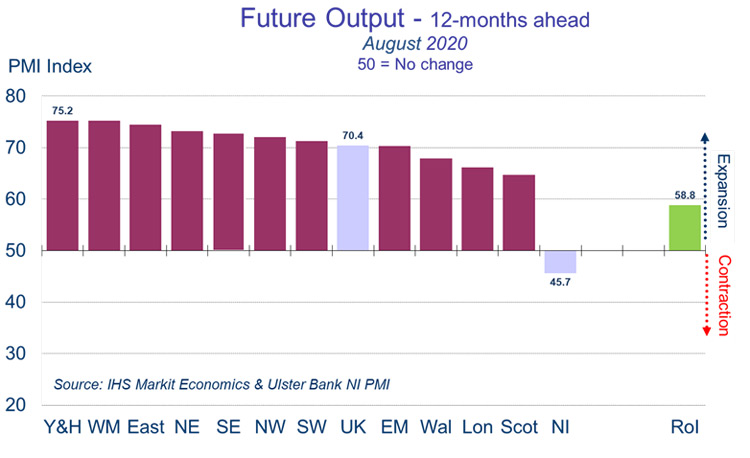

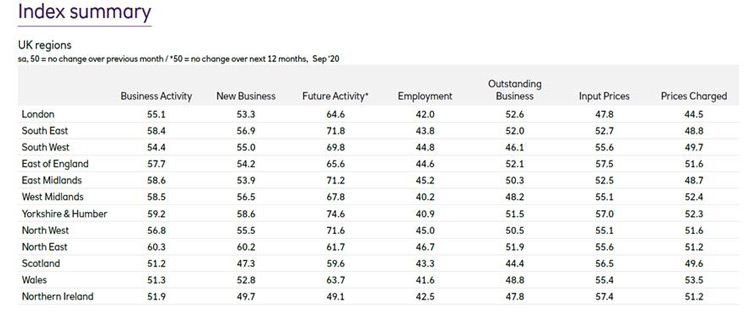

“Northern Ireland’s private sector saw a return to growth in business activity in the third quarter with all four sectors posting positive rates of expansion. This followed the record rates of decline in the second quarter. Indeed, Q3 (52.7) marked the first time since Q4 2018 that business activity exceeded the 50.0 expansion / contraction threshold. While Q3 witnessed a pick-up in the pace of growth in business activity; other indicators (new orders, export orders and employment) all continued to contract, albeit at a much slower rate than Q2’s break-neck speed. Some sectors have experienced more vigorous recoveries than others. Manufacturing, construction and retail all recorded robust rates of output growth in the third quarter. This contrasts with a more lacklustre performance within the services sector.

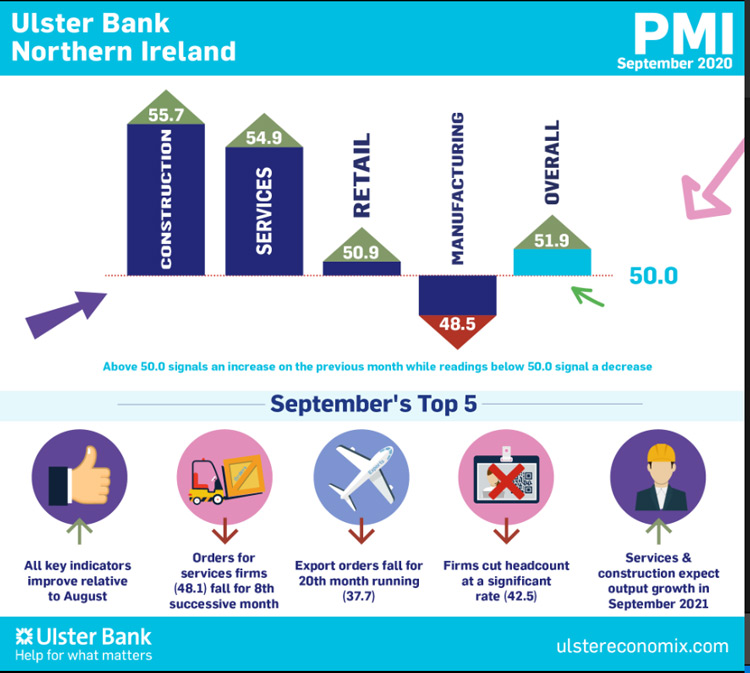

“Looking at the monthly growth trajectories, as opposed to the quarterly figures, it is noted that all of the key indicators improved in September relative to August. Business activity increased at a slightly faster rate in September but failed to match the pace set in July - the first full month after lockdown. New orders broadly stabilised last month after a notable fall in August. However, this conceals contrasting fortunes for the domestic and export markets. The former has seen a pick-up in demand but order books continue to be weighed down by plunging export orders. It is noted that Northern Ireland’s most important export market – the Republic of Ireland – slipped back into contraction territory in September following two months of growth.

“At a sector level, there has been diverse performance across a range of sectors. Manufacturing saw its run of three consecutive months of output growth come to an end and was the only sector to report a fall in output in September. Meanwhile construction and services posted the fastest rates of growth in business activity with services (54.9) expanding at its strongest pace in 26 months. Sustaining that momentum will be tricky with new orders falling for the eighth month running. Conversely, construction reported a notable surge in demand for new work in September, with orders rising (from a very low base) at their fastest pace since February 2016. The one area where there is consistency across all sectors is employment. All four sectors continued to reduce staffing levels at a significant rate.

“Northern Ireland’s private sector has entered the fourth quarter in better shape than it started the third quarter. However, the pace of recovery remains relatively weak with the low hanging fruit on the growth front already plucked. What little momentum the economy has will be tested by the headwinds of more restrictions associated with the resurgence in the number of new COVID-19 cases and Brexit. While more support measures from Westminster and Stormont will be forthcoming, the recovery will struggle to gain traction in this environment.”

The September PMI report for Northern Ireland, the NatWest report for the UK regions and the Republic of Ireland’s Construction are attached for your information. Further PMI material including a chart pack, podcast and infographics are available at www.ulstereconomix.com