Output falls at fastest pace since May last year amid COVID-19 lockdown

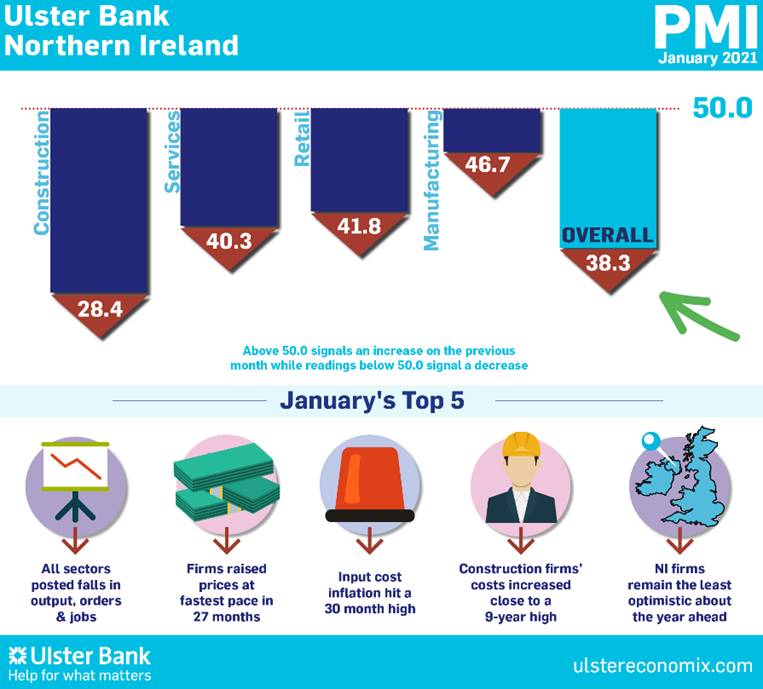

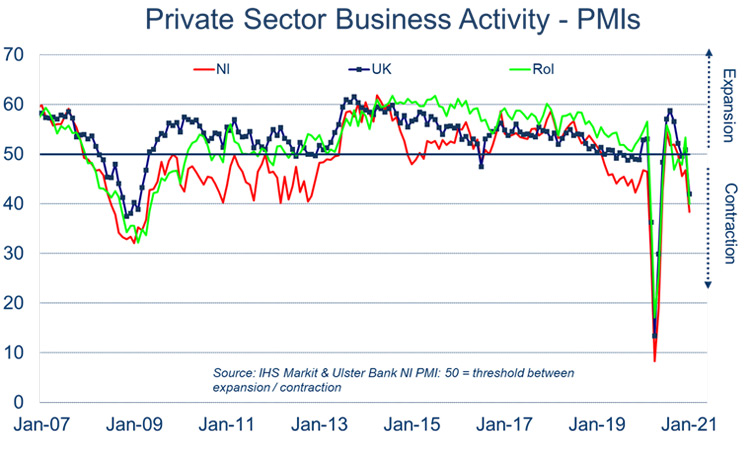

Today sees the release of January data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by IHS Markit – indicated that the Northern Ireland private sector moved deeper into contraction territory at the start of 2021 amid a further coronavirus disease 2019 (COVID-19) lockdown. Meanwhile, inflationary pressures continued to strengthen, largely as a result of higher shipping costs.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

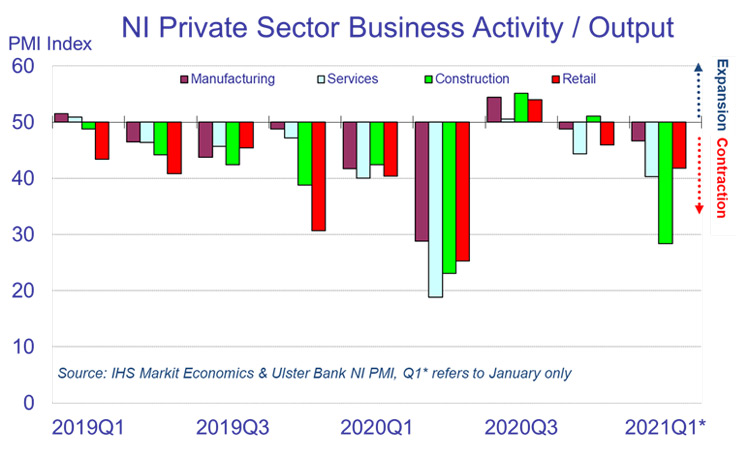

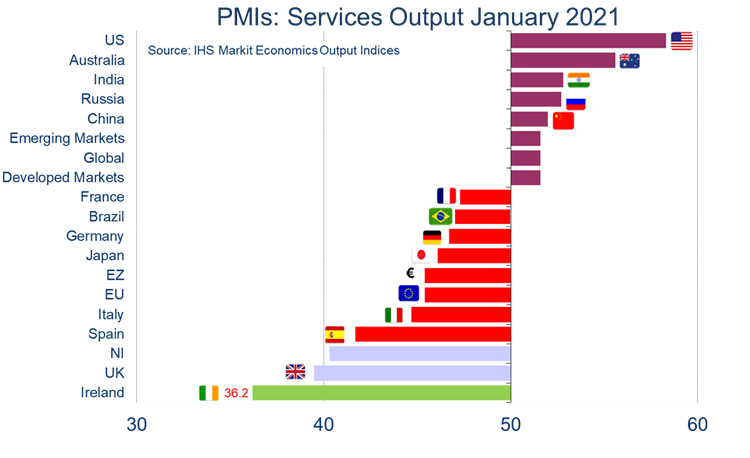

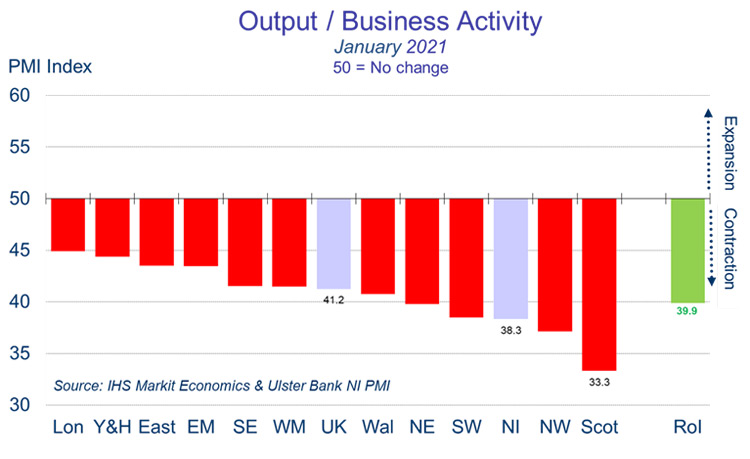

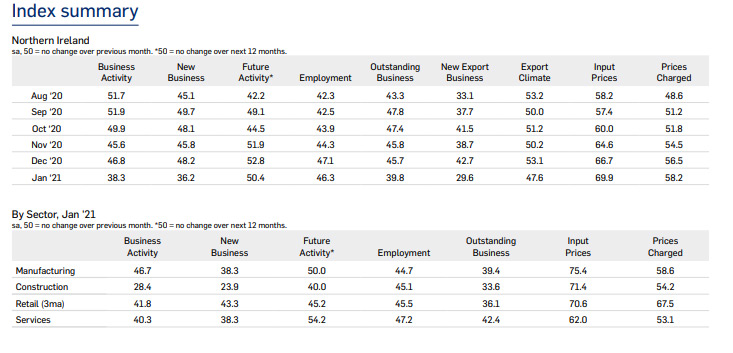

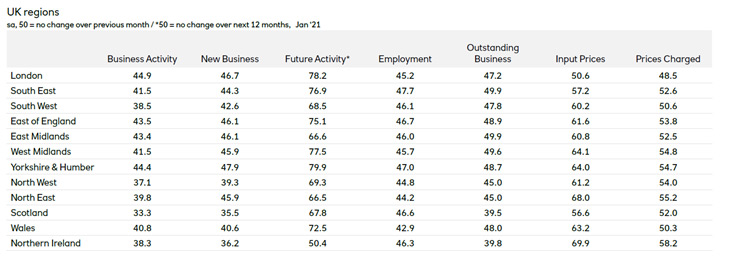

“All twelve UK regions started 2021 with the sharpest deterioration in business conditions since May last year. Lockdown restrictions were the primary cause of the slump in demand back then and in January. There was also a consistent theme across all 12 UK regions as far as new orders and employment were concerned, with contractions across the board. Within Northern Ireland, this theme of falling output, orders and employment was also evident across all four sectors. Manufacturing, construction and retail all posted their fastest rates of decline in output and orders since May. While the services sector posted its weakest readings since June for these indicators.

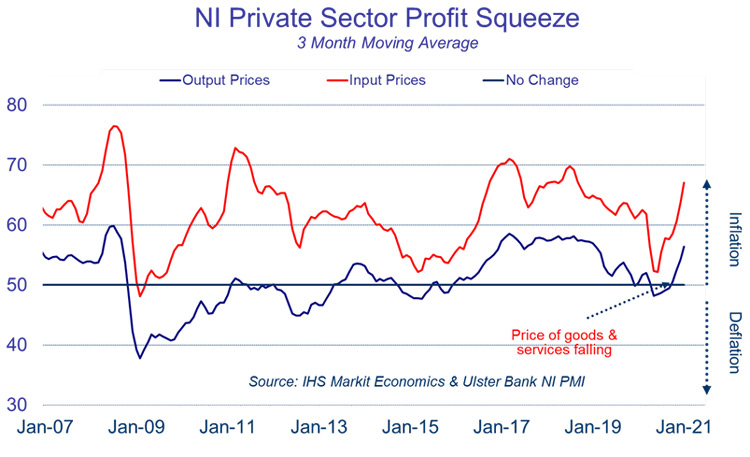

“While January’s rate of decline in business activity was not as steep as that recorded during the first lockdown, some regions – most notably Northern Ireland – reported much stronger rates of inflationary pressures. Indeed, Northern Ireland’s firms signalled the highest rate of input cost inflation across the UK with input prices rising at their fastest rate since June 2018. Higher shipping costs were widely cited alongside higher raw material costs and increased transport costs linked to the new Brexit arrangements. As a result of these cost pressures, local firms, most notably retailers, hiked the price of their goods and services at the fastest pace since October 2018.

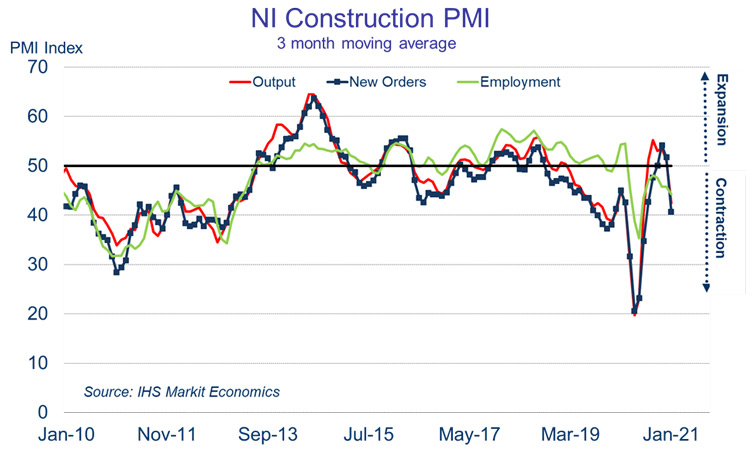

“Profit margins are being squeezed across all sectors but particularly construction. Just a few months ago the construction industry was the best performing sector in terms of business activity and new orders. But January has seen construction activity and orders plummet into the twenties, which denotes a severe drop in demand. Meanwhile input cost inflation amongst construction firms soared to the fastest in almost nine years.

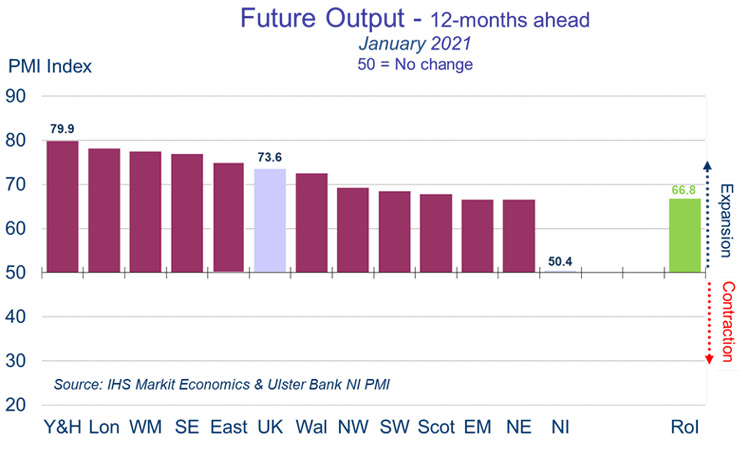

“Against this backdrop it is not surprising that construction firms are the most pessimistic about the year ahead. Alongside retailers, construction firms expect output/ sales to be lower in 12 months’ time. Services remains the most upbeat about growth prospects for the year ahead and the only sector expecting activity to be higher in 12 months’ time.

“2021 has been the year of the rollout on two fronts. The rollout of the vaccine will be the single biggest factor driving economic performance later in the year. Meanwhile the rollout of red tape linked to the new Brexit arrangements will hinder Northern Ireland’s economic recovery by adding costs to business and restricting trade. While Northern Ireland has the advantage of remaining within the EU’s single market for goods, it finds itself on the wrong side of a regulatory sea-border which has effectively redrawn the map of the UK’s single market and customs union.”

The January PMI report for Northern Ireland, the NatWest report for the UK regions and the Republic of Ireland’s Construction are attached for your information. Further PMI material including a chart pack, podcast and infographics are available at www.ulstereconomix.com