Output growth slows to nine-month low

Today sees the release of December data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by IHS Markit – indicated that a reduction in consumer confidence amid the emergence of the Omicron variant led to a further decline in new orders, while growth of business activity was only fractional. Inflationary pressures remained elevated. On a more positive note, a further solid rise in employment was recorded and firms were optimistic regarding the outlook for output in 2022.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

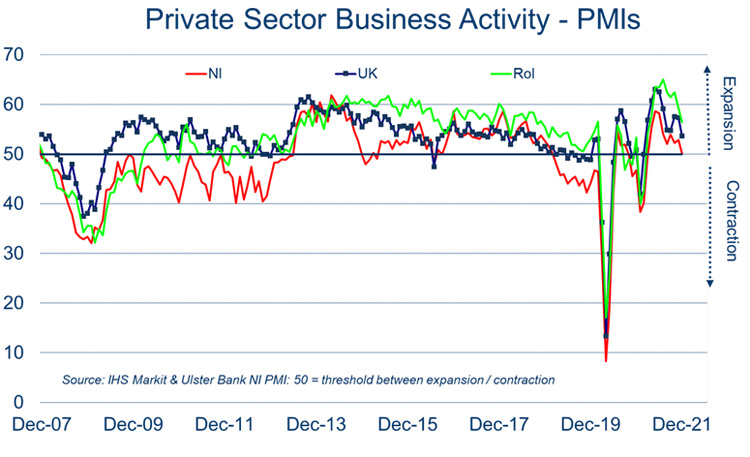

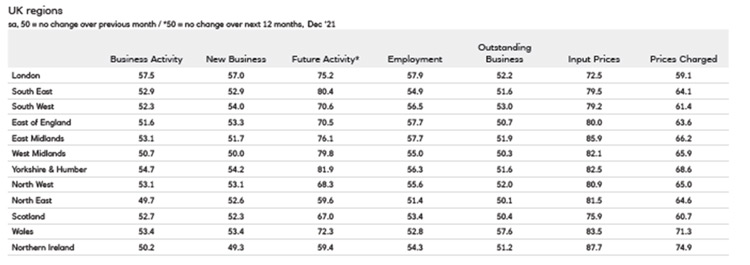

“A resurgence of Covid-19 infections, linked to the omicron variant, in December acted as a headwind for growth throughout the UK. 11 of the 12 regions reported slower rates of expansion with one - the North East of England – posting a marginal contraction.

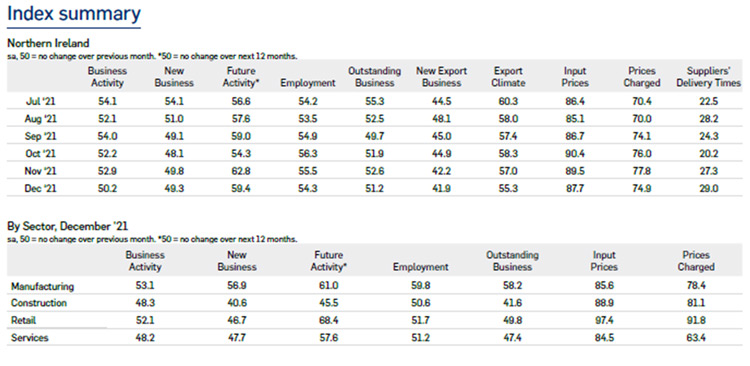

“Northern Ireland’s private sector recovery almost ground to a halt in December with the rate of growth in business activity scraping just above the no change threshold of 50.0 at 50.2. That was the weakest rate of expansion for the 11 UK regions recording growth last month.

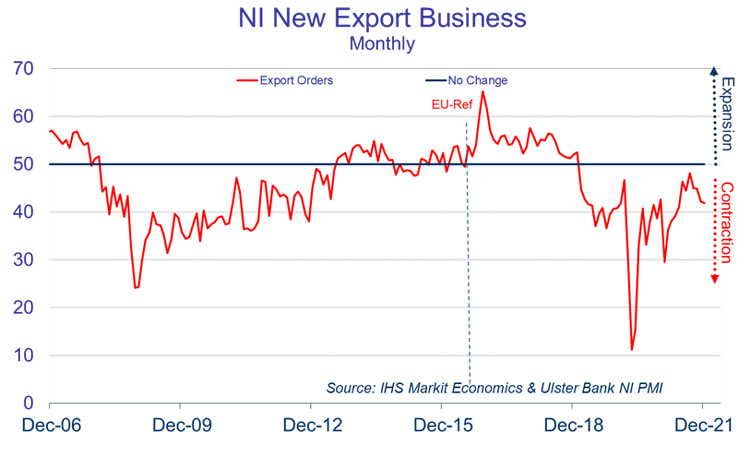

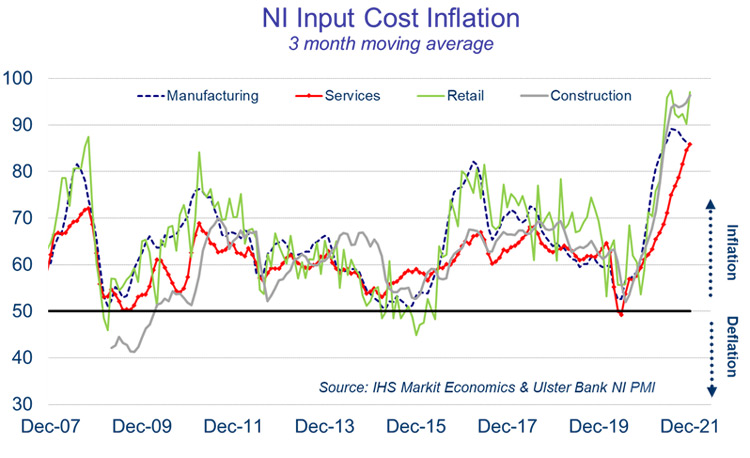

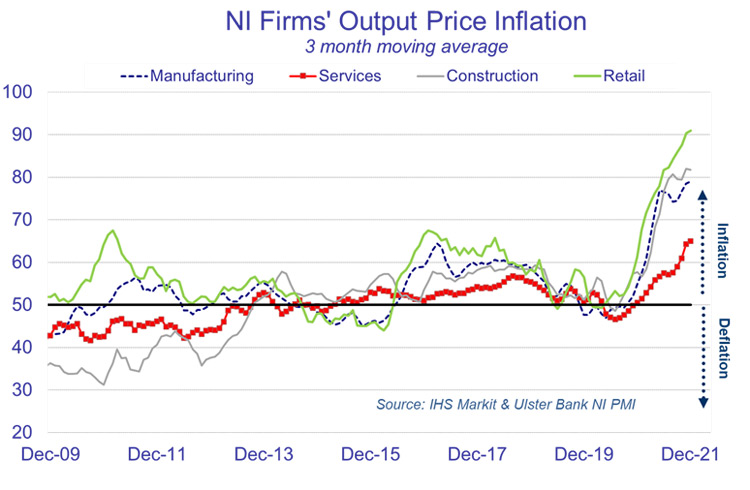

“No rapid improvement is anticipated anytime soon with new orders declining for the fourth month running and export orders contracting sharply, extending the current sequence of decline to 35 months. Inflationary pressures remain severe, while suppliers’ delivery times continue to lengthen sharply.

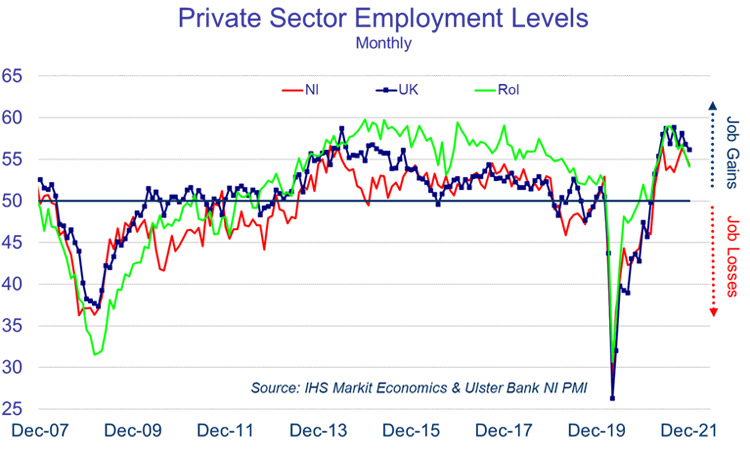

“Despite these near-term challenges, local firms notched-up their 10th successive month of employment growth with all four sectors increasing their headcount. All sectors bar construction also anticipate strong rises in output by the end of the year. Retail, perhaps somewhat surprisingly given the cost-of-living pressures, is its most optimistic since March 2018. But with retailers increasing their prices at a record rate, it remains to be seen whether consumers will share that optimism.

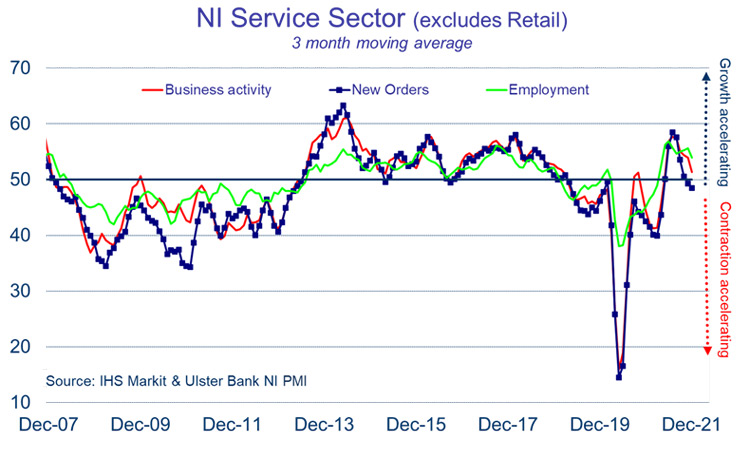

“Northern Ireland’s underperformance compared to the rest of the UK and the Republic of Ireland is due to the construction and services sectors. These two sectors saw activity fall in December whereas retailers and manufacturers posted growth. Manufacturing was the only sector to report a rise in new orders with retail, services and construction all signalling a drop in incoming work.

“2022 is going to be dominated by three economic themes that were prevalent at the end of last year – slower growth, severe inflationary pressure, and the stop-start disruption associated with Covid. This might ease in the second half of the year, however, don’t forget Brexit. Whilst we should be over the hump of the pandemic by mid-2022, the same can’t be said for Brexit as some of the current grace periods come to an end in July.”

The December PMI report for Northern Ireland, the NatWest report for the UK regions and the Republic of Ireland’s Construction are attached for your information. Further PMI material including a chart pack, podcast and infographics are available at www.ulstereconomix.com