Output growth softens to five-month low

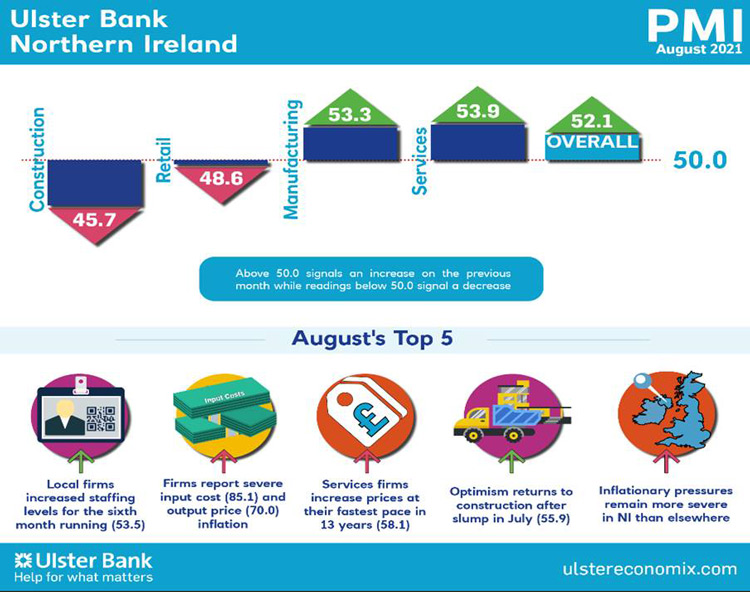

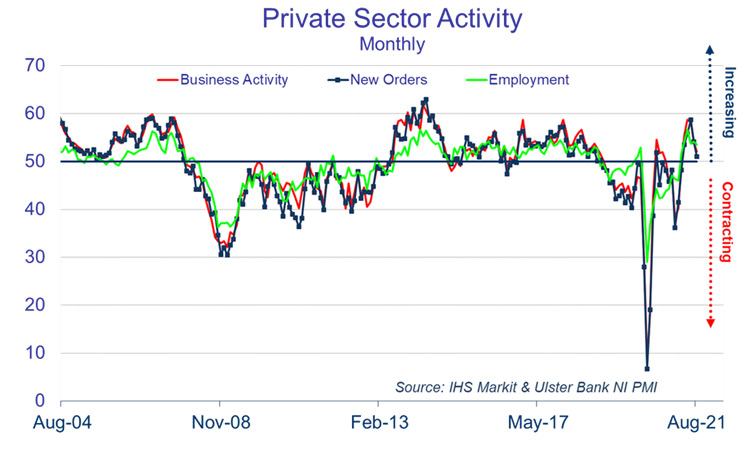

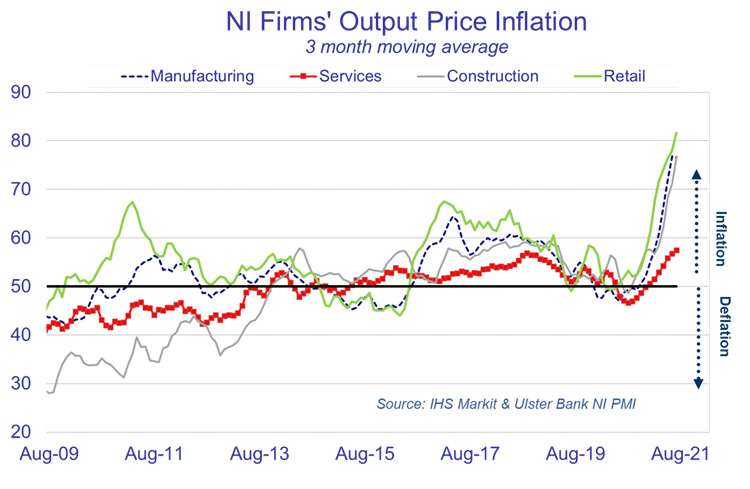

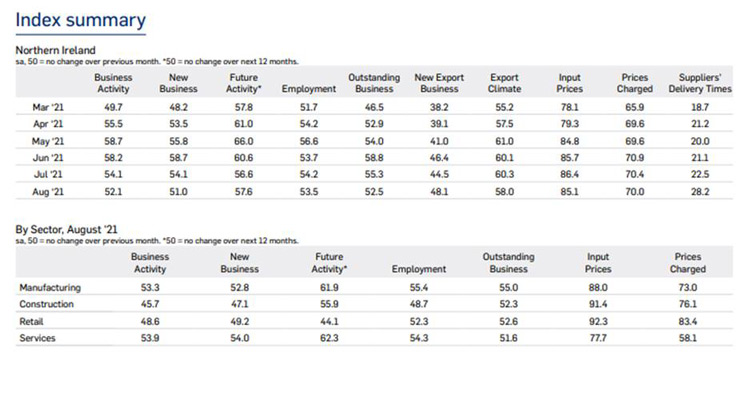

Today sees the release of July data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by IHS Markit – showed signs of growth in the Northern Ireland private sector losing momentum, with both output and new orders rising at softer rates. Solid job creation continued, however. Meanwhile, near record increases in input costs and output prices were recorded.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

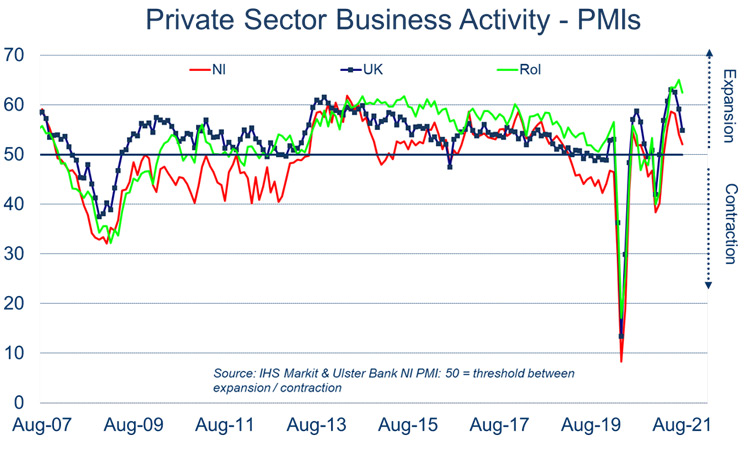

“Most of the UK regions saw business activity grow at a slower rate in August, and Northern Ireland was no exception. Last month marked local firms’ slowest rates of growth in output, orders and employment in five months. But a two-speed recovery was on show in August at a sector level.

“Manufacturing and services firms saw some loss of momentum in August but still chalked up reasonable rates of growth in output and orders while staffing levels continued to rise at a solid pace. But retailers joined construction in contraction territory, with falling sales and orders. Hiring within retail though continued last month.

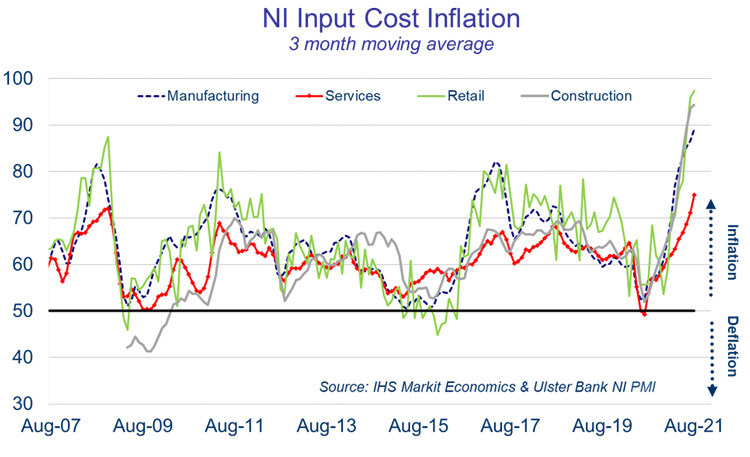

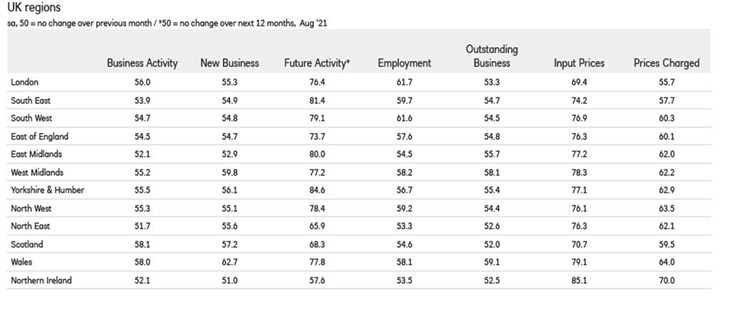

“Elsewhere, the survey revealed again an all too familiar story, with inflationary pressures and lengthening supplier delivery times. Within the UK, Northern Ireland continues to report the steepest rises in input costs, with local firms raising the prices of their goods and services at faster rates than any other region. Price pressures linked to raw materials, fuel, freight, wages and Brexit continued to be cited by survey respondents. Inflationary price pressures in August eased only marginally relative to their recent record highs, although services firms raised their prices at the fastest pace in 13 years.

“Optimism amongst local businesses for activity a year ahead improved marginally in August, largely reflecting a sharp rebound in sentiment within construction. This follows the Finance Minister’s announcement that new and existing public sector contracts will make allowances for inflationary prices and supply-chain disruption. Meanwhile, manufacturing and services firms remain very optimistic about future activity, with retail the only sector to expect sales activity to be lower in 12 months’ time.

“In the meantime, firms will continue to grapple with inflationary challenges, supply chain disruption, skills shortages and adapting to Brexit. But as we saw last week, increased taxation in 2022 will further add to businesses’ mounting cost burden.”

The August PMI report for Northern Ireland, the NatWest report for the UK regions and the Republic of Ireland’s Construction are attached for your information. Further PMI material including a chart pack, podcast and infographics are available at www.ulstereconomix.com