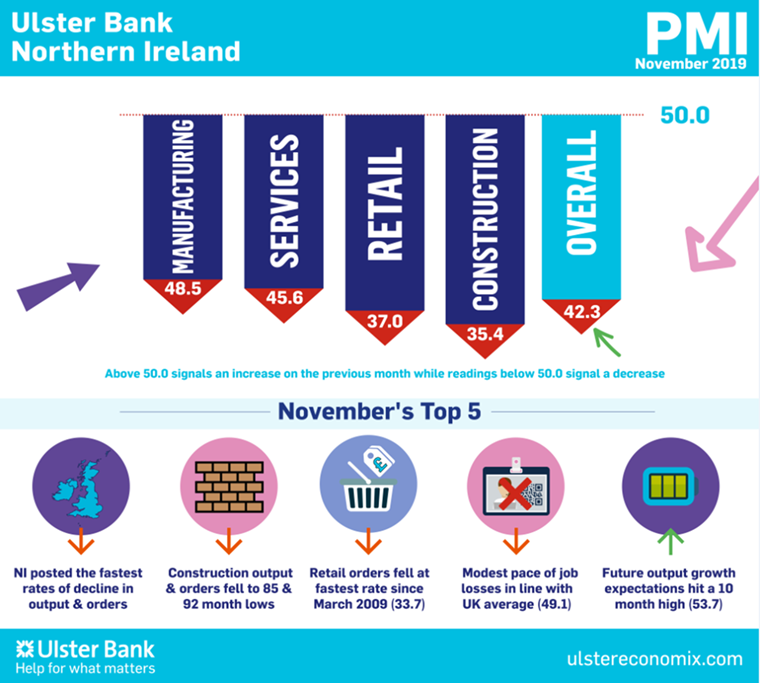

Sharpest fall in business activity for seven years

Today sees the release of November data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by IHS Markit – pointed to sharper declines in output and new orders at Northern Ireland companies, as Brexit uncertainty continued to weigh on activity. Employment also decreased, albeit at a relatively modest pace. Meanwhile, the rate of input cost inflation remained marked, but efforts to stimulate sales led companies to raise their selling prices at only a marginal pace.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

“One of the most striking aspects of the latest survey is the continued resilience of the labour market, with firms broadly maintaining their staffing levels despite a big fall-off in demand. Indeed, the pace of decline in business output and new orders fell to seven and seven-and-a-half-year lows respectively last month.

“All four sectors have posted falling output in six of the last seven months; however, the performance of retail and construction are of particular concern. Construction order books continued to shrink for the 15th month in a row and November marked the sharpest rate of decline in 92 months. It is a similar story for retailers with orders falling at their fastest pace since March 2009.

“In this environment, firms’ desire to maintain staffing levels comes at a cost to profit levels. The latest survey shows that input price inflation continued to rise in November, but firms are not able to pass these increased costs onto their customers and indeed discounting is widespread in an attempt to generate new business.

“Firms therefore seem willing to take a hit to their profits in the short-term in the hope that conditions will improve once there is greater certainty around the situation with Brexit. Indeed, their expectations for the year ahead are relatively upbeat overall with an expectation that business conditions will have improved marginally in 12-months’ time; albeit that this is largely confined to manufacturing and services.

“This may well prove to be overly optimistic however as even if a Brexit deal is passed there is still much to be decided around the new relationship with the EU and how any new arrangements would work. Uncertainty will therefore continue to be very much present in 2020.”

Key Quarterly Data for Q3 2019

- Business Activity = 44.7 (lowest since Q4 2012 = 27 quarter low)

- New Orders = 42.7 (lowest since Q2 2012 = 29 quarter low)

- Employment = 47.9

- Exports = 39.0 (lowest since Q3 2011 =31 quarter low)

Sectoral Business Activity / Output Q3 2019

- Manufacturing = 43.7 (lowest since Q1 2009 = 42 quarter low)

- Services = 45.7 (lowest since Q4 2012 = 27 quarter low)

- Construction = 42.4 (lowest since Q4 2012 = 27 quarter low)

- Retail = 46.0

The November PMI report for Northern Ireland, the NatWest report for the UK regions and the Republic of Ireland’s Construction are attached for your information. Further PMI material including a chart pack, podcast and infographics are available at www.ulstereconomix.com