Slowest rise in output in 23 months

Today sees the release of September data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by IHS Markit – signalled a further loss of growth momentum across the local private sector. Business activity, new orders and employment all rose at weaker rates, while sentiment dropped to the lowest in the 19-month series history. Rates of both input cost and output price inflation remained elevated, but continued to ease at the end of the third quarter.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

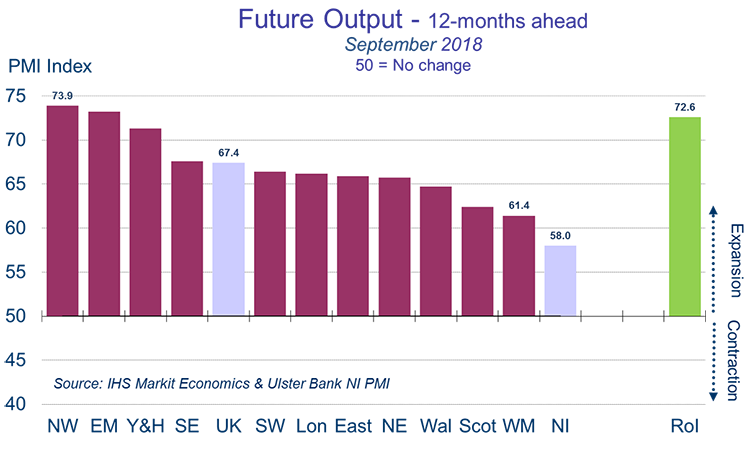

“September marked Northern Ireland’s slowest rate of private sector growth in 23-months, considerably behind that recorded at the beginning of the third quarter. This meant that Northern Ireland slipped down the UK rankings from being the fastest growing private sector in the UK in July to being second from bottom in September.

“This slowdown isn’t entirely unexpected, given that July received a significant weather-related boost, and taking the quarter as a whole, the deceleration looks more modest. However, the July-September period still marks the slowest quarterly rate of private sector growth that Northern Ireland has seen in five quarters. In addition, Northern Ireland’s poorer performance at the end of the quarter relative to the rest of the UK can’t be explained solely by the weather, given that July’s sunshine was a UK-wide phenomenon.

“Indeed, Northern Ireland firms are now the least optimistic in the UK, and their most pessimistic since this indicator began 19-months ago, with Brexit a major concern for respondents. Notably, the construction sector, which had been experiencing something of a relative purple patch, is seeing expectations fall. Firms in this sector now expect their workloads to be lower in 12-months’ time than they are currently, with major public sector infrastructure projects being put on hold.

“All sectors experienced a slowdown in September in terms of activity, orders and job creation. However, all sectors are still in growth mode, for now at least, and manufacturing is still outperforming relative to its long-term average. Inflationary pressures have also shown signs of easing. However, what does or doesn’t happen regarding Brexit will exercise Northern Ireland businesses in the quarters ahead and looks set to continue to impact on both confidence and activity.”

The September PMI report for Northern Ireland and the NatWest report for the UK regions are attached for your information. Further PMI material including a chart pack, podcast and infographics are available at www.ulstereconomix.com