Third successive monthly fall in activity

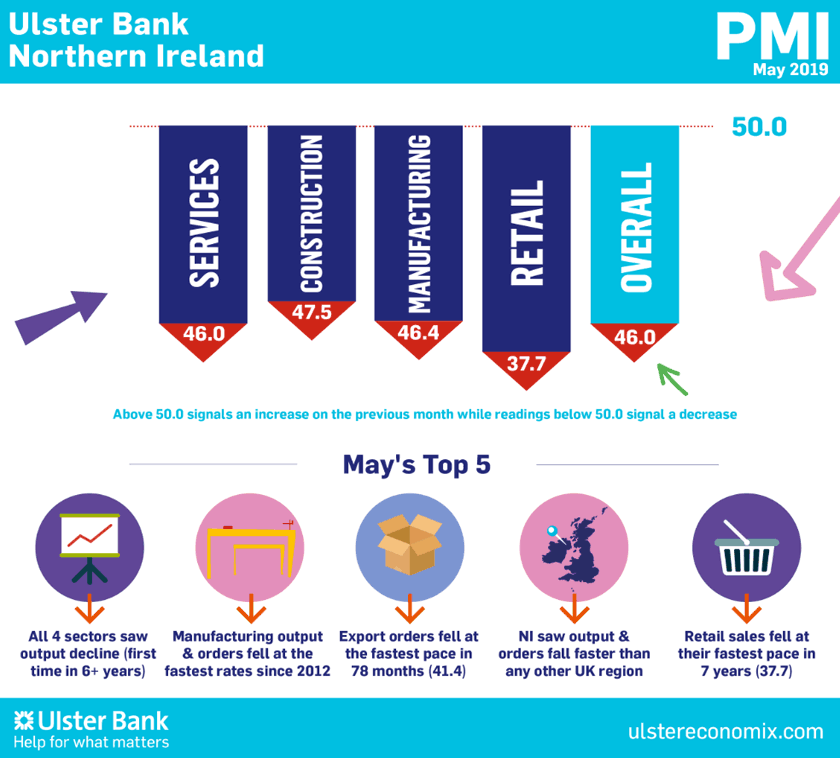

Today sees the release of May data from the Ulster Bank Northern Ireland PMI®. The latest report - produced for Ulster Bank by IHS Markit - indicated that the Northern Ireland private sector remained in contraction territory. Activity and new business continued to fall markedly, often linked to Brexit uncertainty. In turn, companies lowered their staffing levels again. There was some relief on the price front, as the rate of input cost inflation eased. That said, the extent of input price increases far outweighed that of selling charges again during the month.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

“What the latest PMI suggests is that the global slowdown which had been impacting other economies is now clearly evident within Northern Ireland. Brexit stockpiling by manufacturing companies had been inflating the performance of local firms in recent months. Now that the rapid phase of stockpiling activity has passed, the latest PMI data reflects the reality of current demand. This is weakening in both the domestic and overseas markets, with output at 76-month low and orders falling at an 81-month low.

“It’s not just manufacturing that is weakening; all four sectors saw falling output for the first time in six years. Respondents in the retail sector pointed to sales activity falling at the fastest rate since May 2012, and retailers are scaling back their employment activity as a result.

“Looking ahead, orders books across all sectors suggest that the current period of weakness will continue. Construction firms have now reported falling orders for nine-successive months and retailers have been reporting falling sales every month in 2019 to date.

“In terms of employment, whilst private sector firms are continuing to reduce staffing levels, it should be remembered that this is from record employment highs and the labour market remains relatively strong. Notably, despite the current challenges, the level of pessimism amongst respondents regarding the 12-months ahead has eased. Indeed, Northern Ireland firms expect output to have risen in a year’s time. So whilst firms expect challenges in the short-term - citing Brexit as one of the key factors – their expectations for the longer-term are marginally better.”

Please view the The May PMI report for Northern Ireland and the NatWest report for the UK regions. Further PMI material including a chart pack, podcast and infographics are available at www.ulstereconomix.com